Highlights:

Poor summer season and elevated channel inventory dented the Q1 earnings of contract manufacturer Amber Enterprises despite production and efficiency measures. While Amber continues to gain market share in the core RAC business, it is also expanding its footprint in the related business segments to capitalise on the opportunities emerging in the domestic manufacturing ecosystem.

Quarterly result highlights

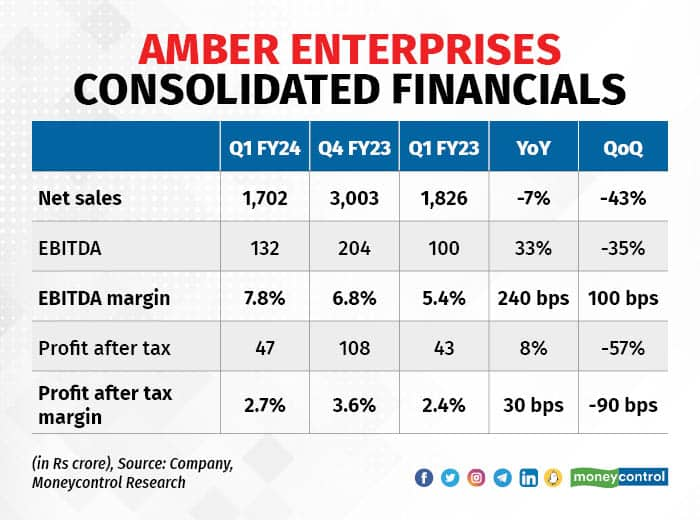

Amber’s Q1 consolidated revenues were dragged down by weak performance in the RAC (room air conditioner) segment as unseasonal rains in the north impacted volume off-take during the peak summer season. Stable raw material prices and favourable product mix (higher share of component manufacturing) led to a year-on-year (YoY) increase in the EBITDA (earnings before interest, tax, depreciation, and amortisation) margin by 230 basis points (bps) to 7.8 percent.

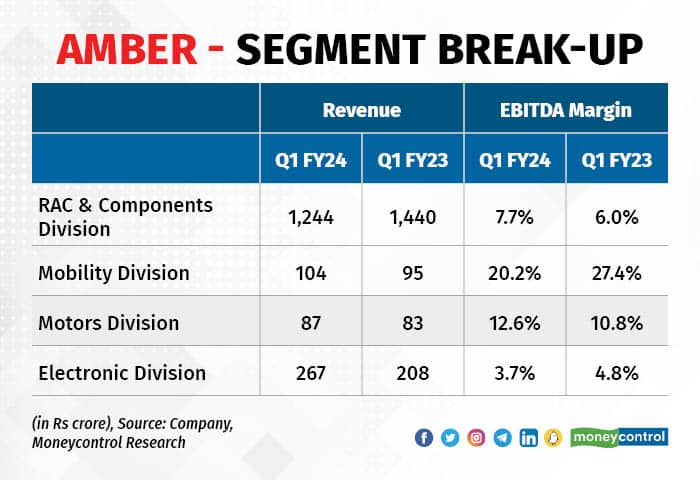

On a segmental basis, Room Air Conditioners (RAC) and component declined by 14 percent YoY on account of unseasonal rains, which impacted retail sales across all brands and distribution channels. Margins benefitted from operating efficiencies and the increasing presence across the value chain (components).

As per the management, the RAC market declined 20 percent in H1 CY23 and channel inventory continues to remain at elevated levels. RAC sales in the last quarter were a complete washout in northern markets, but dealer inventory seems to be normalising gradually as secondary sales in July have been better. Despite a weak start, the management expects the RAC market to grow by 7-8 percent in FY24, with Amber outpacing the industry growth rate by 3-4 percent through diversification in non-RAC components.

The Mobility division, which comprises its subsidiary Sidwal, reported revenues of Rs 104 crore, up 9 percent YoY. Margins for the segment are not comparable with last year due to the low-cost inventory in the base quarter.

The management expects the mobility business to clock revenue growth of 15-20 percent in FY24 with sustainable margins of 20-22 percent. Meanwhile, the order book continues to strengthen owing to the government focus on the modernisation and augmentation of transport infrastructure (railways, metros, highway).

PICL, which engages in the manufacturing of Motor, had a subdued quarter on the back of difficult market conditions. New products and spare capacity headroom (currently around 50 percent) should also help revenue and margins in the coming quarters. However, the revenue guidance for PICL has been trimmed to 20-25 percent (from 30-25 percent) in FY24.

The Electronics division, which comprises ILJIN and Ever, grew the fastest by 28 percent to Rs 267 crore, driven by the wearable segment. Amber projects 35-40 percent sales growth for the Electronics segment and has recently onboarded new customers in the wearable and telecom sectors. Within the segment, the share of the wearables category is expected to rise to 40 percent by FY24-end.

Return ratios to improve

Over the last four years, Amber has spent nearly Rs 2,000 crore on acquisitions and capacity development. The firm expects to spend Rs 350-375 crore in FY24 on capex for brownfield expansion in components, sub-assembly segment, and PLI schemes. The benefits of large-scale investment are yet to accrue and, therefore, the return on capital should climb steadily from here on with the increase in asset turnover.

At the end of Jun-23, Amber had a net debt of Rs 788 crore. The leverage is unlikely to change much until the next summer season.

Outlook and recommendation

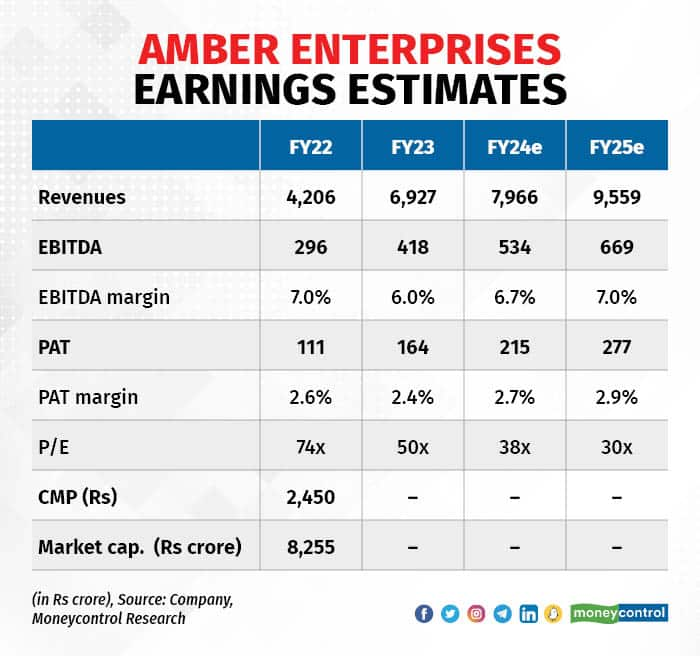

Amber (30 times FY25 earnings).is also focusing on diversifying its revenue mix through various strategic initiatives. To aid volume growth and stick to the commitment of PLI schemes, the company is on track to expand its capacities. We remain optimistic about Amber’s execution and management capabilities, advise investors to accumulate the stock on decline.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now