Highlights

Q1 FY24 – steady quarter

Source: Company

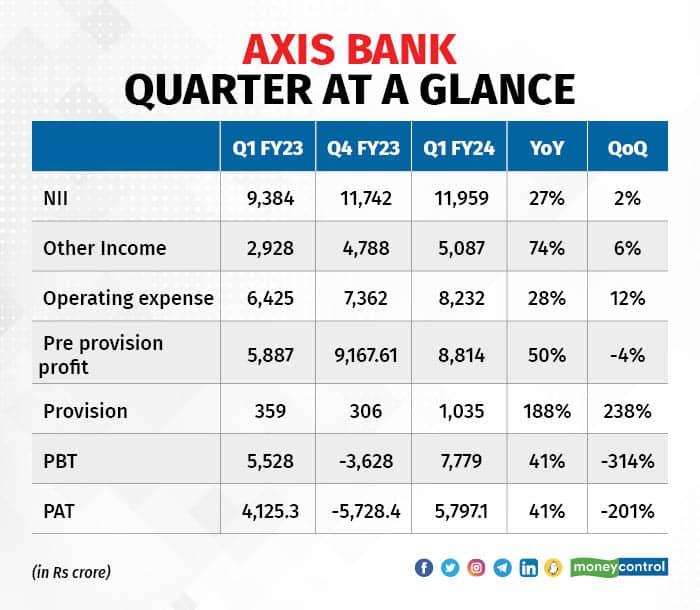

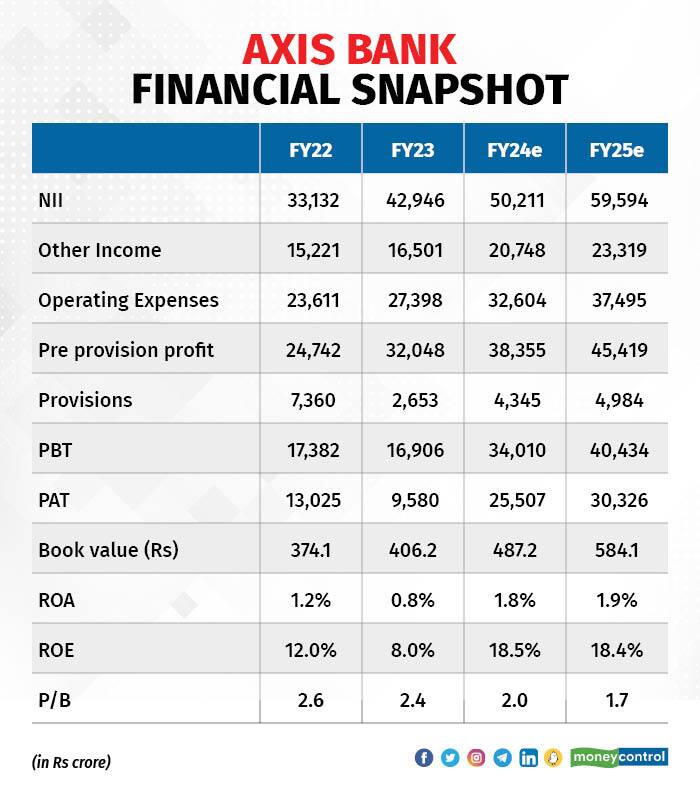

Headline pre-provision profit grew by 50 percent with support from interest as well as non-interest earnings, although costs were elevated. The quarter had the benefit of treasury gains as against treasury losses in the year-ago period. Excluding the impact of treasury, the year-on-year (YoY) growth in core pre-provision earnings was 27 percent.

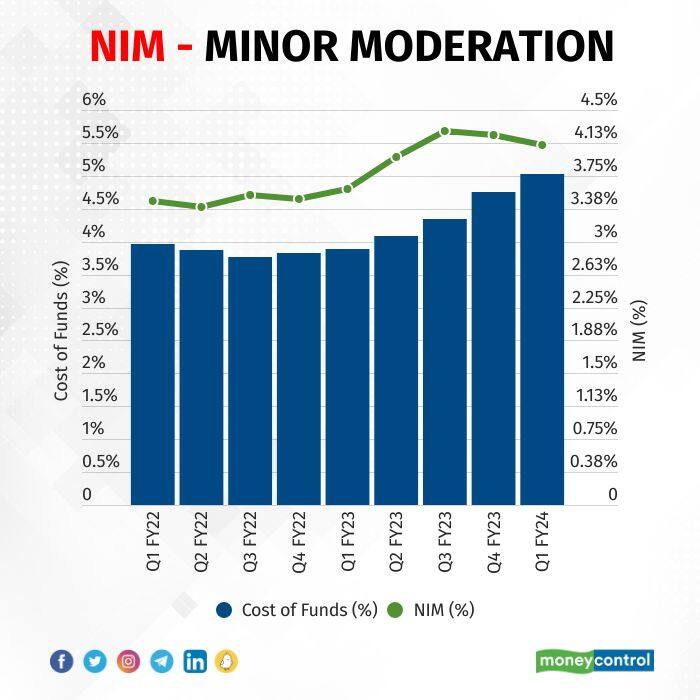

A slight fall in net interest margin

On expected lines, there was a sequential decline in interest margin (NIM) by 12 basis points, thanks to the spread compression as the cost of funds rose faster than the yield on assets. There was also some impact of income tax refund that aided NIM in the preceding quarter.

Source: Company

Source: Company

The bank expects the pace of rise in the cost of funds to slow down. We see the bank deploying some of the levers of margin improvement such as accelerating the pedal on unsecured, which at 13 percent of the loan book is lower than the peers, a gradual reduction in the low-yielding RIDF bonds, a higher share of domestic lending with a focus on the higher-yielding retail and SME, and a gradual improvement in the deposit profile.

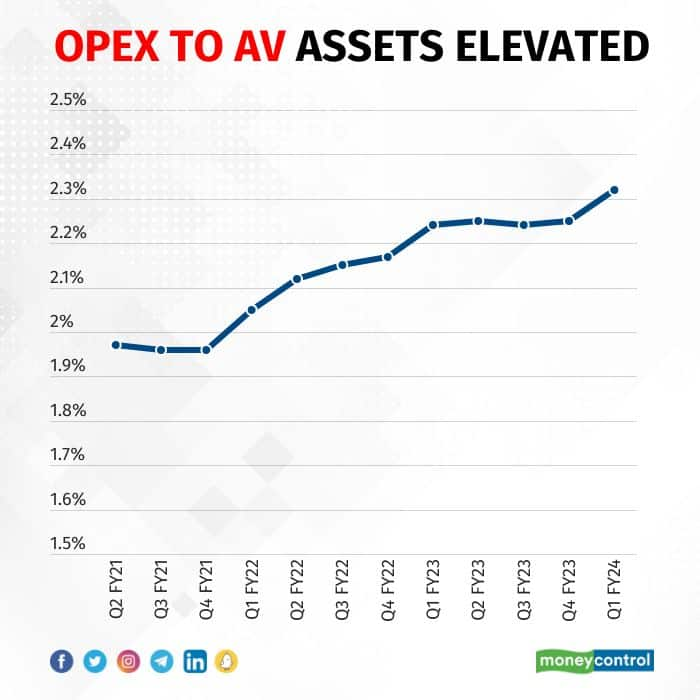

Opex remains elevated

The bank saw a significant increase in operating expenses, especially employee expenses, thanks to the full quarter impact of Citi employee addition, annual increment, addition of people in growth businesses and technology, etc. Sans the quarterly impact of Rs 385 crore for Citi integration, total opex growth would have been lower by 600 basis points at 22 percent YoY.

Source: Company

Source: Company

The bank is still targeting to bring down the opex-to-assets ratio to 2 percent in the next couple of years without the Citibank impact. This will remain a key driver of RoA (return on asset) expansion going forward.

Asset growth healthy

Overall advances growth at over 22 percent YoY was healthy and aided by corporate, SME, and retail. Within retail, which is 58 percent of the book, home loans and LAP (loan against property) were soft and the growth drivers were small business loans, personal loans, credit cards, etc. Since 77 percent of retail assets are secured, there is headroom to grow the high-yielding unsecured.

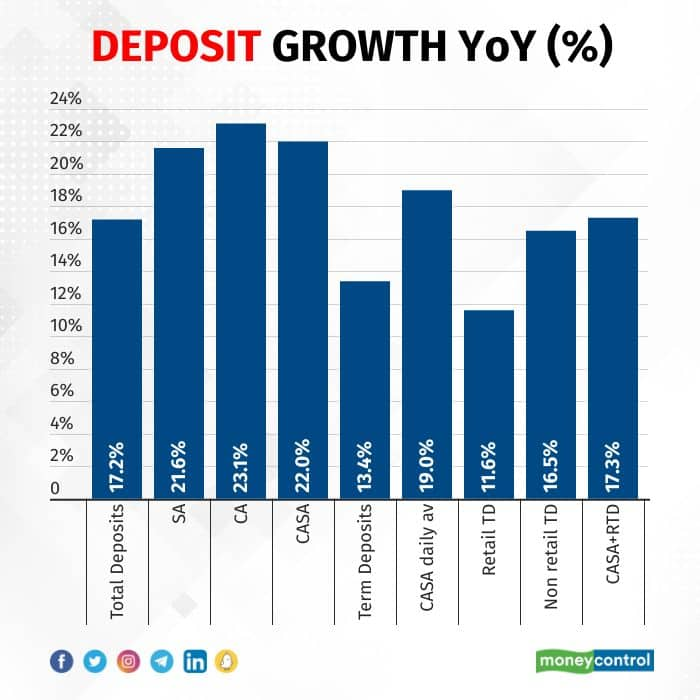

Deposit growth still lags

Sequentially deposits de-grew (contracted?) slightly whereas advances rose 1.6 percent,. Consequently, the credit-to-deposit ratio shot up by close to 200 basis points sequentially to over 91 percent. However, at the cost of growth, the quality of deposits is improving with the low-cost CASA (current and savings account) growing faster with the CASA share improving 180 basis points YoY to 45.5 percent. However, given the hyper competitive market, this is an area that warrants focus.

Source: Company

Source: Company

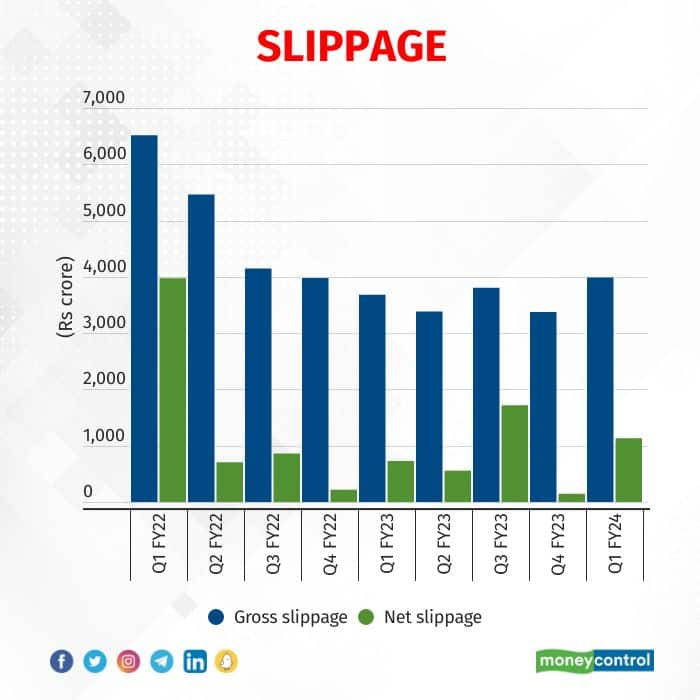

Asset quality stable

While gross slippage was a tad higher sequentially, thanks to higher recovery/upgradation/write offs, the absolute gross NPA was sequentially lower at the end of June 2023. The bank’s reported gross and net NPA levels were 1.96 percent and 0.41 percent respectively as against 2.02 percent and 0.39 percent in the preceding quarter with a decent provision cover of 80 percent. The restructured book is a minuscule 21 basis points of gross customer assets and carries a provision of ~ 21 percent.

Source: Company

Source: Company

With adequate capital — CAR at 17.74 percent with CET 1 ratio of 14.38 percent and net accretion to core capital of 36 bps in Q1, we see a healthy earnings trajectory and improving return ratios.

Source: Company, Moneycontrol Research

While the stock had a decent run in recent times – up 10 percent in the past three months, thereby outperforming the Nifty and the Bank Nifty and could consolidate, any decline could be a great entry opportunity for the long term as we see the bank gradually closing the valuation discount with peers.

Key risks: Unexpected future disruption due to macro uncertainty impacting growth and a substantial worsening of asset quality. Citi integration turning out to be a drag on costs/profits.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now