Brookfield India Real Estate Trust has opened its issue to raise up to Rs 3,500 crore by selling units to institutional investors on a private placement basis to fund the acquisition of two assets in Gurugram and Mumbai. In a regulatory filing, Brookprop Management Services Pvt Ltd, which is a manager of Brookfield India REIT, informed that the issue committee of its board of directors approved the opening of the issue on July 27 for receiving bids.

The panel approved and adopted the preliminary placement document and the application form in connection with the issue. It also approved the floor price of Rs 265.79 per unit, the filing added. The filing did not mention the number of units offered for sale.

Last month, the unitholders approved the raising of funds through an institutional placement of units not exceeding Rs 3,500 crore in one or more tranches. The committee took note of the letter from BSREP II India Office Holdings II Pte Ltd (a member of the sponsor Group) expressing their support towards the closure of the acquisitions of Kairos Property Managers and Candor Gurgaon One Realty Projects.

The committee took note of the letter from BSREP II India Office Holdings II Pte Ltd (a member of the sponsor Group) expressing their support towards the closure of the acquisitions of Kairos Property Managers and Candor Gurgaon One Realty Projects. Pursuant to this, "Its affiliates are willing to subscribe to further units of Brookfield India REIT for an aggregate amount ranging from Rs 8,000 million (Rs 800 crore) to Rs 11,000 million (Rs 1100 crore)”.

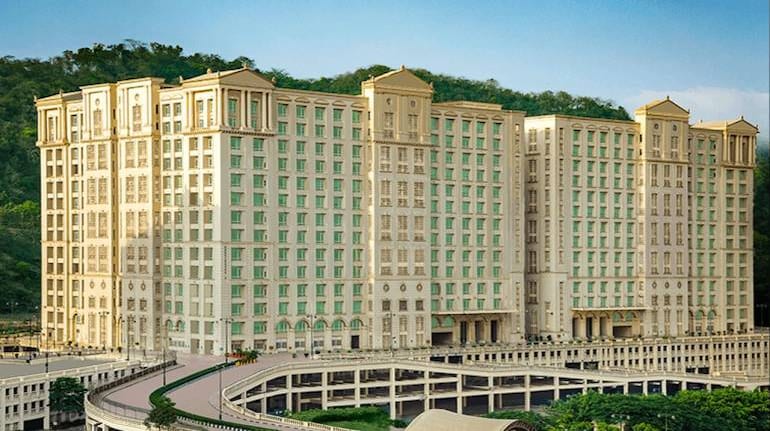

In May, Brookfield India REIT and Singapore’s GIC announced an equal partnership to acquire two commercial properties in India for USD 1.4 billion or Rs 11,225 crore. The two assets in Mumbai and Gurugram have a built-up area of 6.5 million square feet and are owned by Brookfield Asset Management’s private real estate funds.

The two properties are Brookfield’s Downtown Powai, which is a portfolio of nine commercial properties spread over three clusters having 2.7 million square feet of operational area and 0.1 million square feet of area under expansion, and Candor Techspace in Gurugram, which has over 3.7 million square feet of operational space.

Brookfield India REIT is among four listed Real Estate Investment Trusts (REITs) on the Indian stock exchanges. Its portfolio comprises five large campus-format office parks located in Mumbai, Gurugram, Noida, and Kolkata. The portfolio consists of 18.7 million square feet comprising 14.3 million square feet of completed area, 0.6 million square feet of under construction and 3.9 million square feet of future development.

REIT, a popular instrument globally, was introduced in India a few years ago to attract investment in the real estate sector by monetising rent-yielding assets. Rental income earned by REITs is distributed to unitholders. REITs help unlock the massive value of real estate assets and enable the participation of retail investors. Out of four listed REITs on Indian bourses, three are backed by office assets while one is backed by retail real estate assets.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!