If you have not been proactively keeping track of your contributions to your National Pension System (NPS) account, then you are probably not using the best feature that this long-term investment vehicle offers.

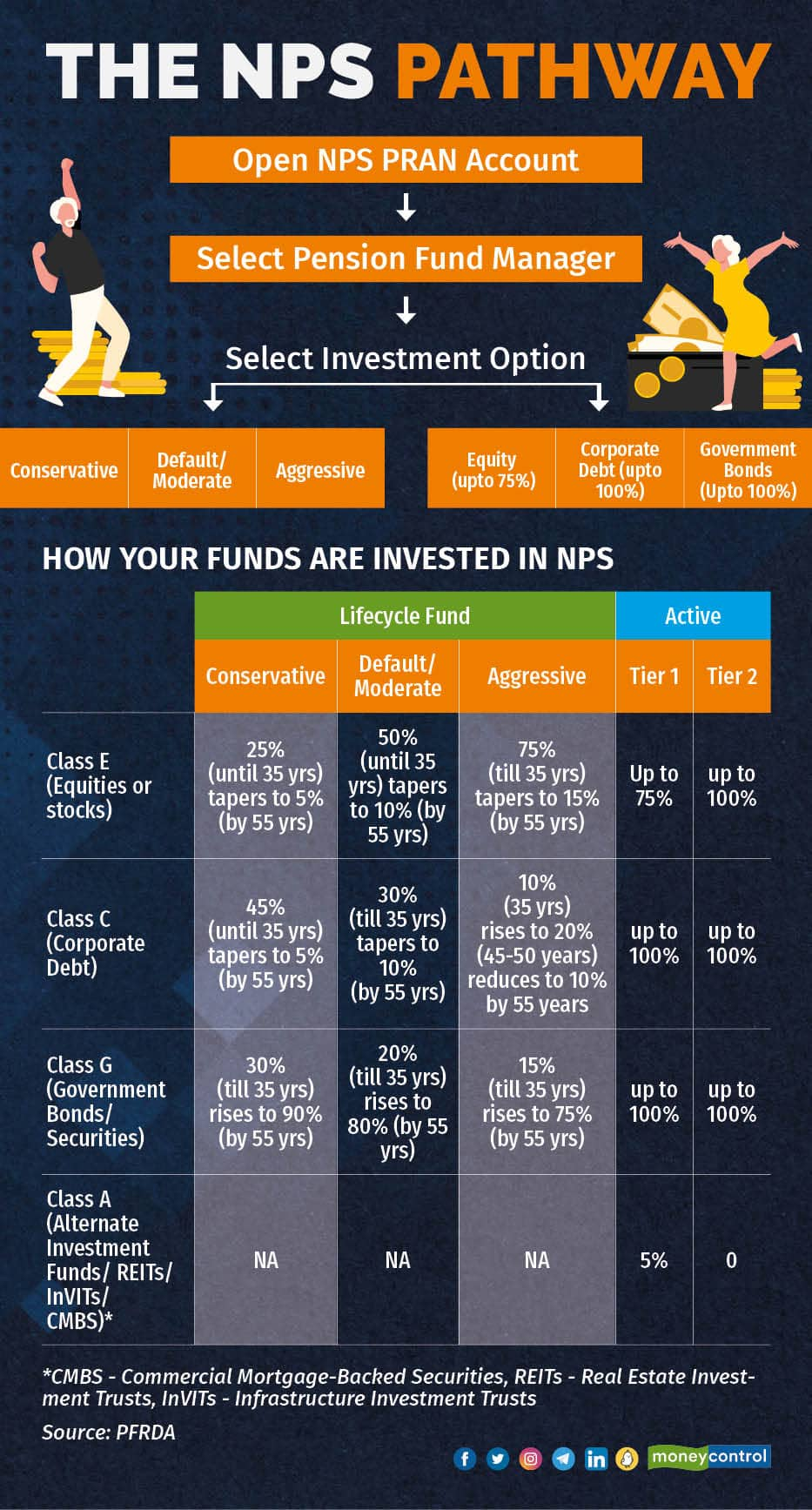

NPS allows you to select not just your pension fund manager but even how much you want to invest across different asset classes – equity, government securities and corporate debt. The NPS offers two investment options – Auto (offers three sub-choices) or Active asset allocation.

The latter allows you greater control over how your money is deployed across asset classes. Through NPS, you can open two accounts – the mandatory retirement account Tier-I and Tier-II, the optional, investment account.

Where is your NPS money invested?

Asset allocation means dividing your investments into different asset classes such as equity, debt, gold and real estate. By not saving everything in one asset alone, you can safeguard the money from cycles of that particular asset class.

“NPS is one of the most tax-efficient investment products, offering the investor an option to decide on the equity exposure (up to 75 percent) for long-term goals and to beat inflation,” says Hemant Rustagi, CEO of Wiseinvest Advisors.

If you do not select any option while opening the account, you would usually have the Auto-Moderate Lifecycle Fund as the default option under your NPS investments. Here, equity investments (Scheme E) reduce as you near your retirement. By age 55 years, higher funds are moved into government securities (Scheme G) and corporate debt (Scheme C) compared to your younger investment days.

This happens in different intensities across the Auto investment option, where you can select between three choices based on your stomach for risk within. You can opt for Aggressive (highest equity exposure of 75 percent), Moderate or Conservative (minimal equity exposure) options.

Why is the Auto option imperfect?

The problem with this Moderate-Lifecycle Fund option is that you can invest only up to a maximum of 50 percent of the money in equity when your age is 35 years. But as you turn older the equity exposure further reduces. For instance, at 45 years, your maximum equity exposure under the Moderate fund would be 30 percent only.

These would be your prime income-earning years.

Rustagi says, “Between 45 and 55 years, you are at the peak of your career and your capacity to invest is maximum and your retirement goals are at least 10-15 years away.”

So if you use the Active investment option, then you can select the amount of money you want to invest in equity, government securities and even corporate debt. While you can invest 100 percent of your funds in G and C options, equity investment is permitted up to a maximum of 75 percent.

Financial planners say if the goal is long term there should be heavy equity exposure to build a sizeable corpus. If you can’t decide how to set your Active option limits, you can seek help from an advisor.

Deepali Sen, Founder Partner- Srujan Financial Services LLP, says, “One can’t expect debt investments to beat inflation. But equity investments will ensure that the returns are superior to 7 percent of inflation if one stays invested over a long period. However, we should look at equity from a minimum of seven years' horizon.”

How frequently can you change this?

Pension Fund Regulatory and Development Authority (PFRDA) allows you to change the asset allocation under NPS four times a year.

But how much percentage should you allocate to different asset classes under NPS would depend on how you have shaped your entire retirement portfolio.

“People forget to look at the entire retirement portfolio – which would have employee public provident fund, NPS, mutual funds and stocks – to check the exposure to respective asset classes they have invested in for a long-term goal of retirement,” says Mumbai-based certified financial planner Kiran Telang.

When should you start reducing your equity portion?

Ideally, closer to retirement. “You should taper down your equity investments five to seven years before the actual retirement. But you need to understand when you would start drawing from the NPS funds and accordingly set the equity reduction stage,” says Telang.

Remember, though you can join NPS until the age of 65 years, you can hold your contributions and stay invested until 75 years of age.

“The reduction in equity exposure would depend on how much you are dependent on the NPS money. You have the flexibility to remain invested even after you retire,” says Rustagi.

So for instance, after you retire, are you planning to use the fixed deposits first, then the EPF/ PPF? Or have a life-insurance pension fund and some mutual funds and stocks along with NPS? So, you may retire at 65 years but have enough saved under other investment vehicles that you won’t be touching NPS investments until 75 years.

“Considering the enhanced life cycle of 80-90 years, the retirement corpus has to last a person for 30-40 years after retirement. Hence, one can’t be zero equity as inflation will eat away into the returns,” Telang adds.

Moneycontrol's take

Since NPS is one vehicle that allows you to holistically plan the investment portfolio in different assets and gives you flexibility, you should pick the Active option. Higher equity exposure in long-term investments can significantly bolster your retirement kitty, helping you compound money at a faster pace.

And your redemption option under NPS offers you to currently get only 60 percent money tax-free as lumpsum. Rest is invested in an annuity – which is nothing but a product offered by life insurance companies where you get pension money at regular intervals.

As Rustagi says, “At the time of withdrawal 40 percent is stuck in annuity. The returns on annuity are very low. So, when you have the time to build the corpus, asset allocation will play a major role in the returns for around 15-20 years.”

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now