Highlights:

While this was primarily aided by earnings from the US on a year-on-year (YoY) basis, a sequential improvement can be attributed to both the key markets – India and the US.

The company’s chronic portfolio continues to gain strength and the US base business has moved to a new orbit. This is supportive for medium-term earnings growth, which makes us constructive on the business.

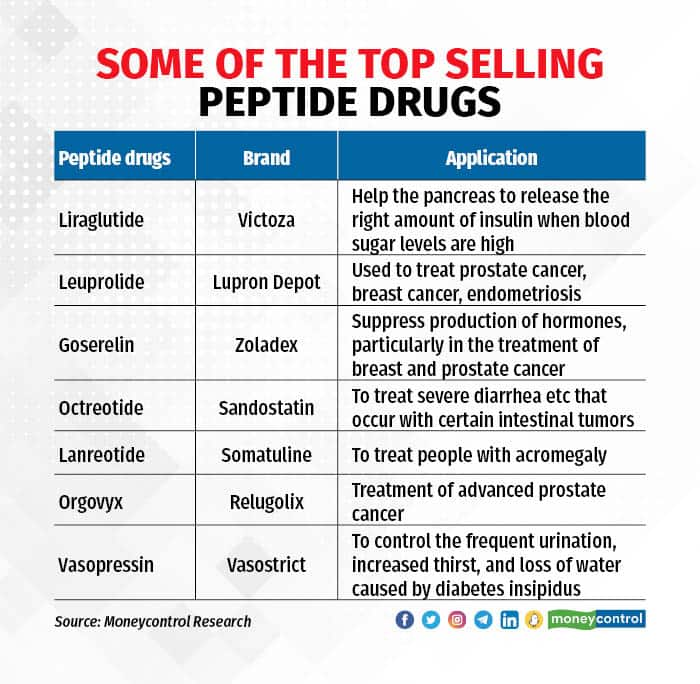

Though the company faced a few regulatory setbacks in FY23, leading to a delay in product launches, remediation appears to be on track. The near-term watch would be product rollouts in the peptide portfolio, particularly Lupron Depot.

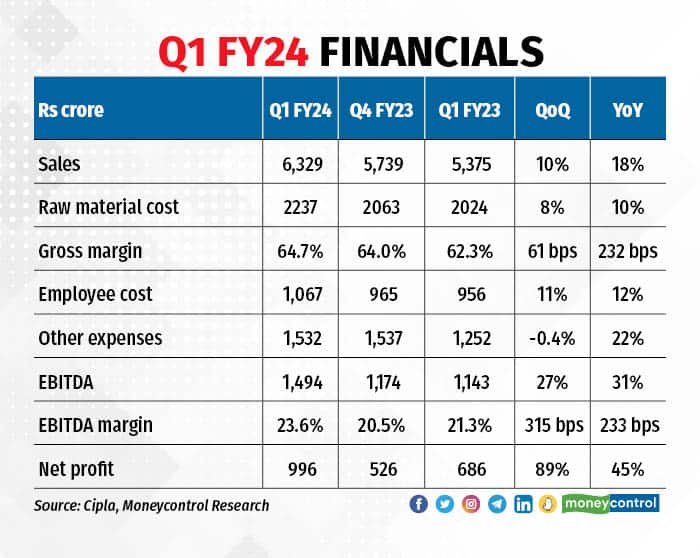

Q1FY24: Margins aided by the US business again

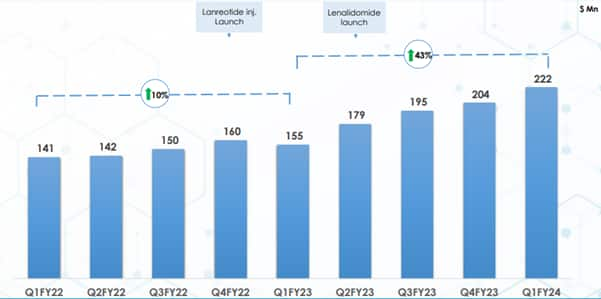

Sales growth in Q1FY24 was once again backed by the US business (29 percent), which grew by 43 percent YoY. The growth in the US business was supported by continued market share gains for the peptide assets (Lanreotide injection).

Here, the company has reached a market share of over 18 percent, above expectations. Further, the traction for g-Revlimid and the base business has been supportive.

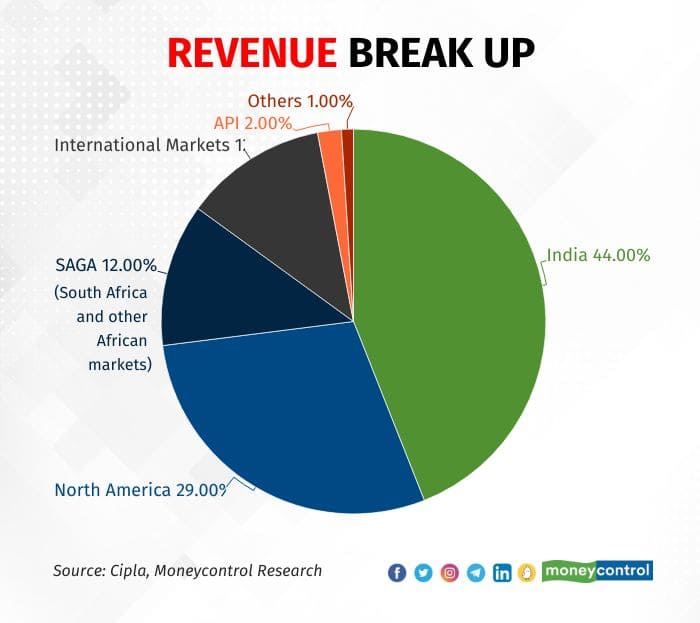

Excluding COVID sales in the base quarter, the domestic business (44 percent of sales) grew 12 percent YoY, helped by the chronic portfolio and consumer health.

Other than that, the South African prescription business picked up but international and API sales were unimpressive.

EBITDA margin improvement was driven by higher gross margins in the US, and moderate pickup in raw material costs, partly offset by higher R&D cost.

Traction in US business

Source: Cipla

Outlook

There is a considerable positive outlook for the US base business, according to the management. It mentions a new quarterly base for the US business as $200-210 million, which is significantly higher than the base of $150 million in FY22. To support that, the company also mentions that Revlimid is not a material contributor to change in earnings on a QoQ basis.

The uptick in market share for the number of products is also attributed to structural changes alluded by the management. This is on account of the rebalancing of supply chain, drug shortages and consolidation in the sector. We see it as an interesting development, though we are still to see if this benefits all the US generics-focused Indian firms.

Price erosion has moderated as well, which is also echoed by the management of Dr Reddy’s.

Coming to delayed launches of Advair (asthma drug) and Abraxane (oncology drug), the company is hopeful that they would be rolled out in FY25. The launch got delayed due to adverse regulatory inspections at the Pithampur and Goa plants.

The reinspection of the Goa plant is expected in H2FY24, and the company is working on remediation measures for the Pithampur plant.

Further, the decline in market share of flagship inhalation product, Albuterol, has been arrested, and the company hopes to build up from here.

In the next 18 months, five launches in the peptides category are expected to support the revenue profile of the US market. Lupron Depot is the key peptide asset to watch. It is used to treat prostate and breast cancer.

In the domestic market, Cipla’s share in chronic therapies has reached 8.6 percent, from 8.4 percent in Q1FY23. This is aided by the strong pickup in diabetic and inhalation therapies. Traction in cardiac therapy is also noticeable.

As far expansion of the field force is concerned, there would be a net addition of 500 medical representatives (MRs) by the end of Q2. Thereafter, it would pause. There appears to be a cut in the original plan of adding 1,000 MRs.

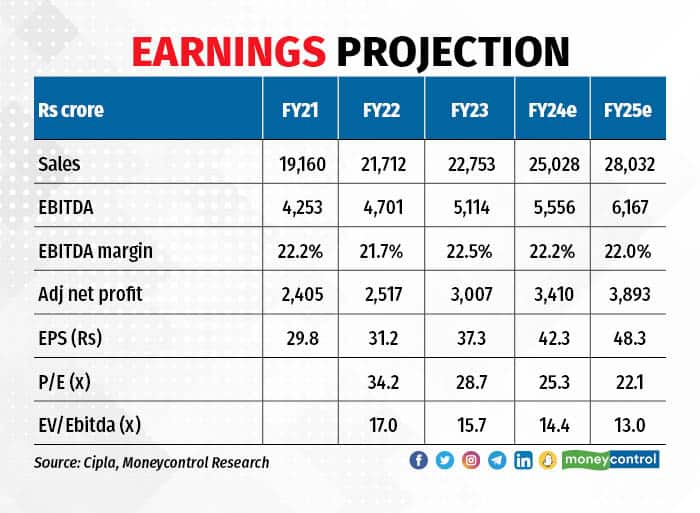

Coming to EBITDA margins, we expect moderation from the Q1FY24 levels as the contribution from high-margin new products subsides. The management guides for a 22-23 percent EBITDA margin in FY24, and we keep our estimates at the lower end of the range.

Having said that, the deployment of net cash (more than Rs 6,000 crore) in the balance sheet would be monitorable. The company would continue to invest in modernisation and capacity expansion at the rate of Rs 1,000-1,500 crore per annum.

The stock is trading at 13x EV/EBITDA FY25e, which is neither attractive nor expensive. But change in prospects for the US market and strength in the Indian market provides a visibility for earnings growth to remain steady. Hence, we are changing stance from equal weight and advise investors to accumulate.

Key risk remains regulatory setbacks.

Twitter @anubhavsays. For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now