Highlights

Quarterly results snapshot

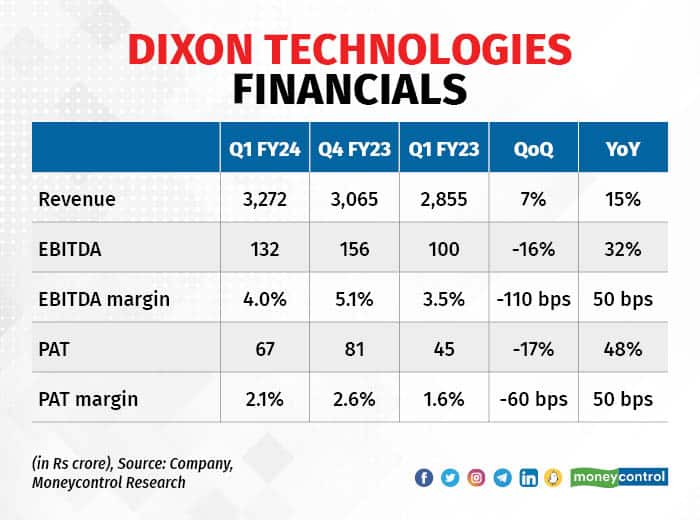

Backed by the Mobile & EMS business, Dixon was able to register a healthy revenue growth of 15 percent year-on-year (YoY) to Rs 3,272 crore. The EBITDA (earnings before interest, tax, depreciation, and amortisation) margin improved 50 basis points YoY to 4.0 percent from a low base of last year.

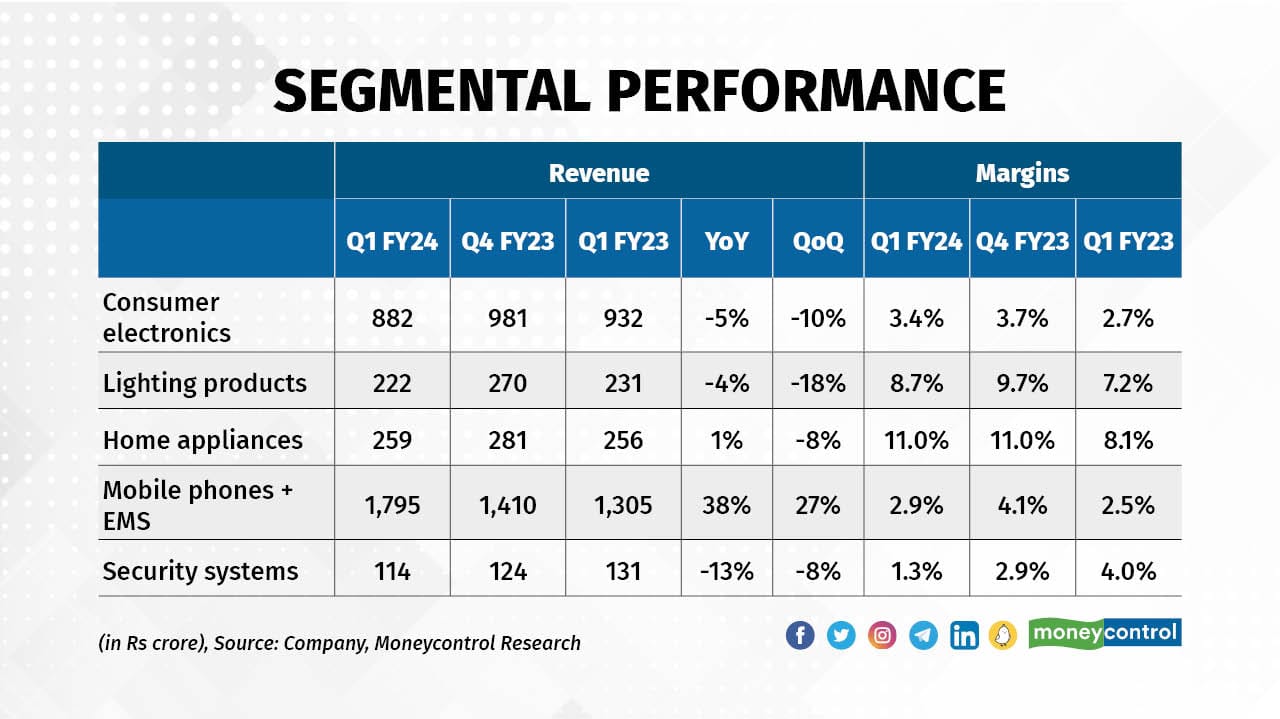

The consumer electronics segment suffered once again in Q1 as TV volumes declined 5 percent YoY to 7.1 lakh units. Moreover, the headline growth was also impacted by accounting adjustments. Revenues for the base quarter, i.e., Q1 FY23, included Rs 71 crore of sales from the air conditioner inverter business, which has now been transferred to the joint venture with Japanese company Rexxam.

Margins for the segment improved by 70 basis points YoY on the back of increased backward integration and an increase in the sales of ODM business (29 percent vs 7 percent in Q1 FY23). Dixon has received the ODM sub-licensing rights from Google relating to Android and Google TV, which is likely to commence in Q2FY24, with the Samsung solutions roll-out expected by Q3FY24.

Post a weak Q1, the management has reduced its TV volume guidance for FY24 by 1 lakh units to 37 lakh units.

Mobile & EMS segment, the largest business vertical, remains a bright spot within the company. The segment grew 38 percent YoY to Rs 1,795 crore, accounting for ~55 percent of Q1 sales. Within this segment, the mobile business grew by just 6 percent as Motorola sales were flat during the quarter. However, mobile revenues are anticipated to accelerate in H2 as the company has onboarded Itel and Xiaomi as new customers. The management expects to start production for these new clients around Sep-Oct. Besides, the strengthening of order book from Nokia as well as Motorola augurs well for the business.

The Hearable and Wearable’s JV with Boat (50:50) is scaling up at a rapid rate with volumes reaching a monthly run-rate of 20 lakh units. The new factory in Noida should give an additional fillip to volumes in the coming months.

IT hardware and Laptop exhibited stable metrics with Q1 revenues of Rs 84 crore. The company is further planning to participate in the revised PLI scheme which is likely to boost its growth. In this segment, its key customers are Samsung and Acer.

Home appliances (washing machines) reported mediocre first-quarter results despite the augmentation of the product portfolio undertaken last year. However, the margins improved on account of price hike, better capacity utilisation, and cost-efficiency measures. The company currently enjoys a healthy order backlog in both semi-automatic and fully automatic washing machines. With the addition of Voltas Beko to its clientele, a strong ramp-up in volumes is expected going forward.

Poor demand and steep price erosion (due to changes in technology) weighed on the Lighting business. To stem the decline, Dixon has entered new product categories such as strips, rope, and professional lighting and on-boarded senior personnel to its R&D division. As for the exports business, Dixon has received its first order from Germany, and is in advanced talks to get new contracts from other countries.

The Security system revenues de-grew 13 percent YoY to Rs 114 crore whereas margins deteriorated due to additional shifting expenses. Dixon has expanded its capacity from 100 lakh units to 140 lakh units per annum, which is now operational.

Refrigerator plant to be ready soon

Dixon expects to complete the construction of a refrigerator plant by 2023-end. The facility in Noida will have a production capacity of 1.2 million units, with a size range of 190-235 litres.

The investment outlay for FY24 is pegged around Rs 400 crore, majorly attributable to the completion of a new plant for refrigerators and the expansion of capacity for mobiles. Besides, some investment will be directed to other segments to meet PLI investment thresholds.

Margins to remain around current levels

During the first quarter, retail activity in the consumer durables industry continued with a lethargic trend seen in the last few months. As for Dixon, order pipeline across major products (excluding consumer electronic and lighting) remains healthy. Additionally, Dixon is operating under various production linked incentive (PLI) schemes, which should aid the top-line growth.

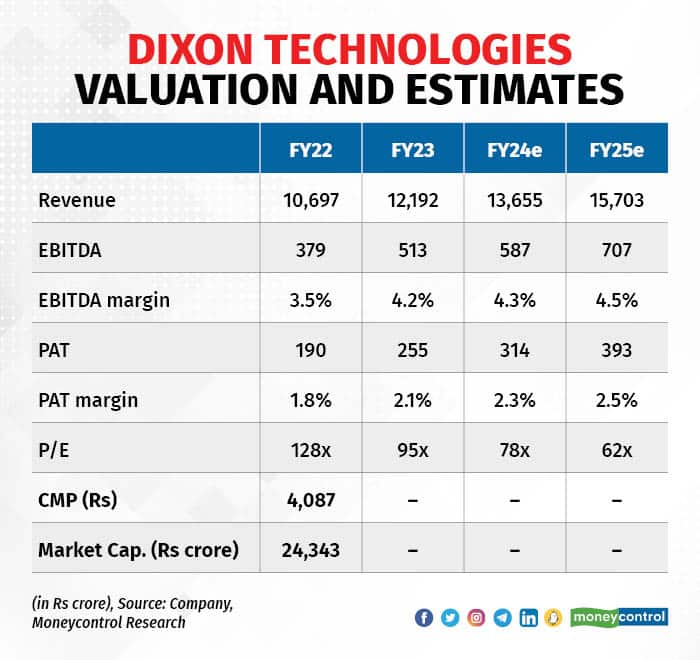

In the second half, Dixon expects better seasonal demand leading to improvements in volume and margin. For FY24, the company expects to maintain operating margins in the range of 4.2-4.5 percent.

Outlook and recommendation

Investor euphoria around EMS (electronic manufacturing systems) stocks remains in full swing. The company has seen a 50 percent rally in its stock price since Feb-23. The herd behaviour in the stock market has once again pushed its valuation into the rich zone.

Investors should remember that bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. Considering the insanity prevailing around EMS space, we believe it will be prudent to partially lock these gains.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now