Highlights

The key growth element missing for Dr Reddy’s is an India story. Its show in India, where it aspires to improve its rank and increase maket share in the chronic portfolio, was mediocre. At present, it is a work-in-progress as the company is doing a portfolio re-jig (exited the derma portfolio, acquired Cidmus) and looking for newer areas (trade generics, child nutrition).

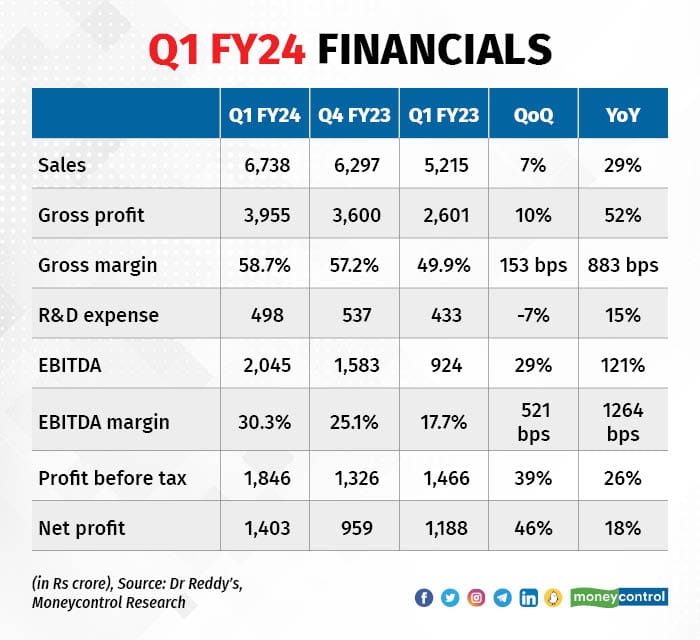

Strong uptick in margins supported by new launches

Sales in Q1FY24 grew by 29 percent year on year (YoY) on the back of a pickup in sales in North America, Europe and Emerging Markets (EMs). North America sales, which account for 47 percent of overall sales, were up 79 percent YoY and 26 percent QoQ, led by new launches, moderation in price erosion and the integration of the Mayne portfolio.

EM business (17 percent of sales) grew by 28 percent. The chief contribution came from Russia, which grew 75 percent YoY. The Russia business was supported by an uptick in biosimilars and the allergy season. The European business, which accounts for 8 percent of sales, was driven by the momentum in the base business.

The domestic formulation business (17 percent of sales) was mediocre, with the reported numbers falling by 14 percent YoY. Excluding divestment of dermatology brands and price reduction under the National List of Essential Medicines (NLEMs), growth would have been in high single digit.

The other disappointment was from the active ingredients business (10 percent of sales), wherein volume pickup was low.

Traction in sales of g-Revlimid and positive pricing environment helped the uptick in gross margins.

India: catering to unmet needs of patients through partnerships

On the Russia business, in conversation with Moneycontrol, M V Ramana, CEO of Branded Markets (India & EM), guided that the company is well positioned for market share gains.

There are a set of companies which are holding up but not bringing their new products to markets. It is these set of companies which stand to lose market share eventually, and Dr Reddy’s, in that context, has an advantage. Also, the company is awaiting permission for a clinical trial for a new chemcial entity (NCE) product in the gastrointestinal area.

As far as the India business is concerned, the company is focusing on the unmet needs in the market, and, to that end, it has licensed several partners in the fields of oncology, CAR T-cell therapy etc. Additionaly, the company is working on improving MR productivity.

In case of China, the company has recently recieved four more approvals, taking the total number of approvals to nine. Higher approvals favourably position the company for the upcoming GPO (Group Purchasing Organisation) tenders.

Outlook

The US business continues to be driven by material contributions from the sales of g-Revlimid. Further, there is less of a drag from price erosion, which is now at high single digit. It was in low double digit earlier. However, both the contributions are not seen to be sustainable for a longer term. Unlike Cipla, the management of Dr Reddy’s does not see any structural change in the US business for their portfolio.

That said, traction in biosimilars would be a key watch. The company’s application for Rituximab biosimilar has been accepted for review by various regulatory agencies. Further, phase 3 studies for tocilizumab biosimilar has been initiated. About 1/4th of the R&D budget is towards biosimilars and the first wave of launches are expected from FY27.

In case of India, underperformance vs. industry remains a concern and material benefit out of portfolio rejig is awaited. Among the new areas to watch is the entry into trade generics and the child nutrition space (launch of CeleHealth Kidz Gummies)

In terms of margins, the management expects the gross margin range to remain elevated in the range of 56-59 percent in FY24. We believe medium-term margins will settle lower than 55 percent.

The company’s balance sheet is healthy, with a net cash of Rs 5,000 crore. A large part of it would be used for product aquisitions, innovations, M&A in Indian and EMs. Further, regulatory record has also strengthened due to favorable outcomes in recent times.

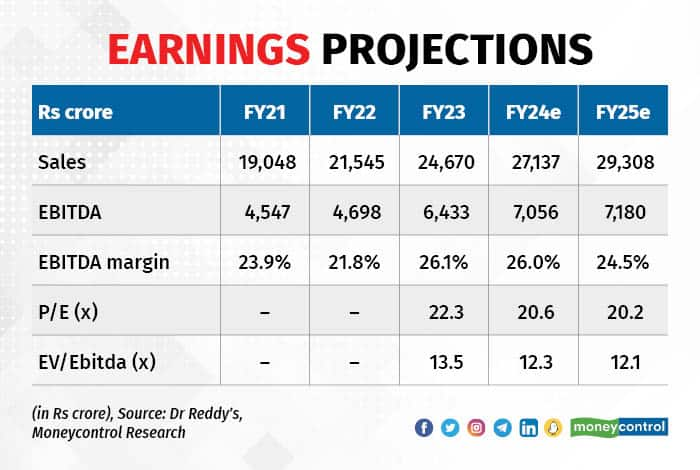

Coming to valuations, the stock is trading at 12.1x FY25e EV/EBITDA, which is close to the fair level. We remain on the sidelines till earnings visibility in India improves.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now