Key highlights

The Prepared Dishes and Cooking Aids (40 percent contribution to revenues for CY22) segment registered a double-digit growth, driven by the Maggi noodles and backed by distribution expansion and supported by relevant advertisement spends.

Milk products and nutrition (32 percent contribution to revenues as per CY22) delivered a strong double-digit growth despite inflationary pressures. Growth was driven by Milkmaid and Peptamen. The growth was further aided by the launch of Resource Fibre Choice and Everyday Zero Added Sugar.

Confectionary (16 percent contribution) saw double-digit growth led by Kitkat and Munch. Nestle supported the growth through strong consumer engagement and media campaigns.

The beverages (11 percent contribution) product group saw a double-digit growth, led by a greater household penetration.

The pet-care business (introduced 2 quarters back) continued to provide complete nutrition for cats and dogs. Felix has received positive feedback from trade and cat parents.

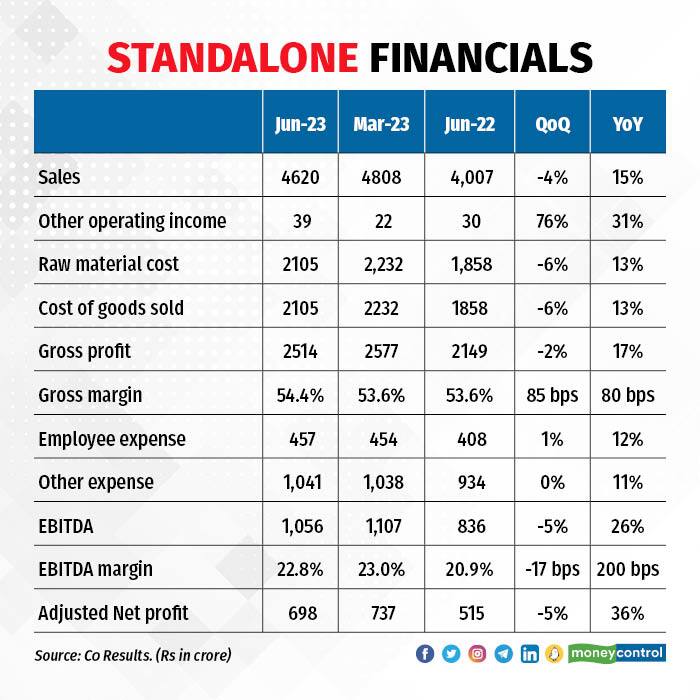

Gross margins improved thanks to the softening of raw material prices along with price hikes taken and the change in mix. The EBITDA (earnings before interest, tax, depreciation, and amortisation) improved on the back of higher gross profits and the operating leverage.

The PBT and PAT both were higher on the back of a higher EBITDA, other income, lower depreciation, and interest cost.

Nestle’s Rurban strategy has helped to increase its distribution footprint of relevant portfolios, thereby achieving higher penetration. Nestle reported strong growth across mega cities and metros, robust performance in Tier 1-6 towns, and continued growth in rural markets. E-commerce performed strongly and now accounts for almost 6.5 percent of sales.

The organised trade channel delivered a broad-based growth across categories, driven by store expansion and improved footfalls.

Out-of-home posted growth on the back of premium products and portfolio transformation. Strong performance is the outcome of kiosk expansion and the prioritisation of emerging channels.

Nestle launched three notable products in the Indian markets. Resource Fibre choice, Everyday Zero, and Munch breakfast cereals.

Outlook and Valuations

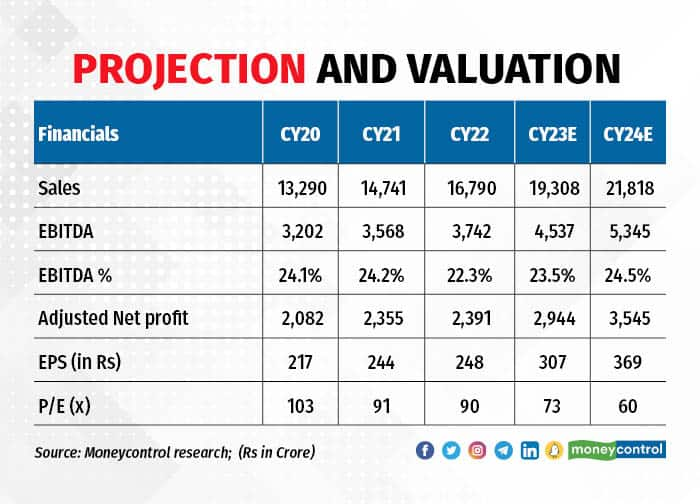

Nestle is a play on the packaged foods business and the management continues to focus on volume growth. Nestle has consistently grown in double digits across key product categories. Along with volume growth, premium products in core categories have got good response so far. Nestle’s direct reach has increased to 1.5 million outlets in CY22 from 1.4 million in CY21, with the total reach remaining steady at 5.1 million outlets. Lower unit price packs were introduced in the rural markets which helped Nestle deepen penetration, while an increase in distribution network aided growth.

Commodities such as edible oil, wheat, and packaging material have seen softer prices. A reversal of price trend is noted in fuels. Fresh milk has seen price stability. Robusta coffee prices are at higher levels and are expected to remain volatile.

Moreover, Nestle has the option to explore new categories which it can introduce in the Indian market at an appropriate time. Nestle’s parent operates in 7 categories while Nestle India operates in 5 categories.

Nestle has committed a capex amounting to Rs 894 crore in Odisha to set up a food processing unit. Nestle has already spent Rs 625 crore in the H1CY23 compared with Rs 240 crore in 1HCY22 while in CY22 it had spent Rs 550 crore.

We continue to remain positive on Nestle and investors, expecting moderate returns, can add and accumulate on declines.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now