Buying a home is perhaps the most significant financial goal that individuals work towards or put their money to. However, unlike a few decades ago, home buying today often comes with a home loan. While you get to own your home where you can build a life on your terms, the loan, its interest costs, other associated costs and terms and conditions are all dictated by the lending bank or financial institution.

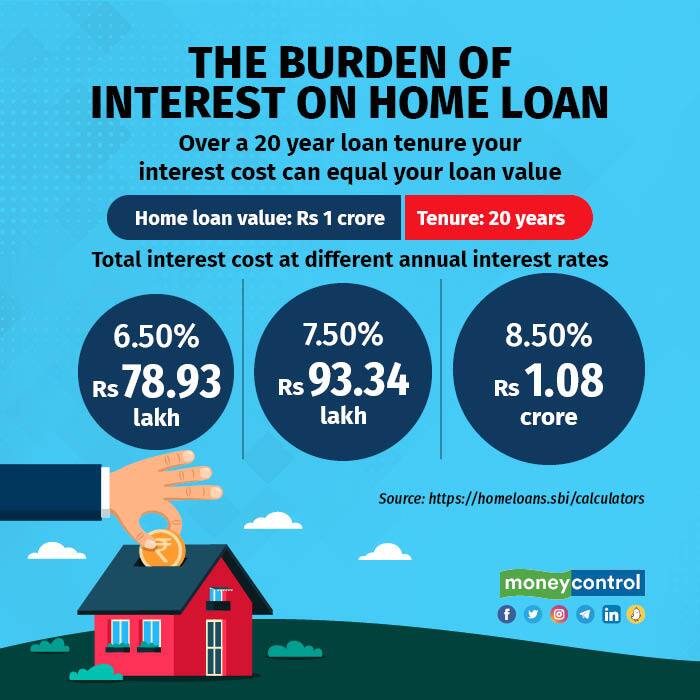

Home loan interest and the subsequent monthly repayment, thus, can become a proportionately large portion of the monthly expense of a typical family. Moreover, taking 20 years to repay the home loan and paying an interest cost which is often almost as much as your home value, if not more, is not financially beneficial.

Also read | India’s middle-class and the EMI conundrum: 4-step guide to reducing the home loan burden

How does prepayment reduce your interest cost?

Amol Joshi, founder, Plan Rupee Investment Services, says that while ideally, one should look at minimising the loan and putting in maximum equity while buying a house, the opposite happens. “The focus for those taking a home loan often shifts to looking for the best property on factors like size and amenities; they stretch the home loan to a maximum,” he says.

However, remember that a large-sized home loan comes with large-sized costs. A 20-year loan repayment cycle ensures that your total interest cost at around 8.5 percent a year can well be equal to the value of your home loan. If you keep your loan outstanding for the entire 20-year tenure, you will end up paying at least double (see table 1).

To reduce this cost, it’s important to begin the repayment journey early as the interest cost is usually front-loaded or a higher proportion of the monthly repayment in the initial years of the repayment.

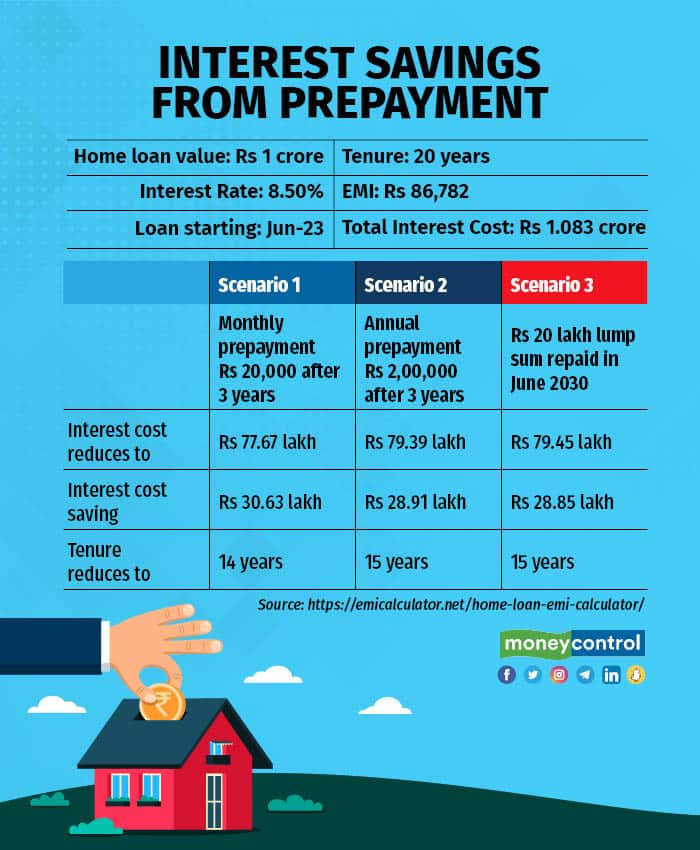

The repayment scenarios in table 2 show that you can reduce your total interest cost by as much as Rs 20-25 lakh on a 20-year loan by starting a repayment schedule after the first three years of the loan. The overall loan tenure also reduces to 14-15 years instead of 20 years.

On the other hand, if you delay the repayment schedule and begin only after 10 years, the interest cost saving is negligible.

Borrowers, however, should not just focus on a limited prepayment schedule but work towards completely repaying the loan as early as possible.

“With interest rates possibly headed higher, prepayment is an option well worth exploring to bring down overall interest costs,” says Deepali Sen, founder partner, Srujan Financial Services LLP. And even if interest rates begin to go down in a few months — as many experts are predicting — it still pays to prepay your loan, given that interest rates move in a cycle.

Table 2 shows some limited scenarios of prepayment, however, a lot more cost saving is possible if you step up monthly prepayment every year. The overall tenure can get reduced to below 10 years and you feel the pinch less since the step-up in repayment can be aligned to annual salary increments or bonuses.

How soon should you prepay your home loan?

The numbers don’t lie and it’s clear that repaying your home loan brings significant cost savings and cannot be ignored.

However, finally it’s your prepayment action which will make the difference. The good news is that experts have seen that Indian home loan borrowers don’t hold on to debt for too long.

“Our data shows that till 10 years ago most loans closed between 7 and 9 years and now that timeframe has moved up to around 9-12 years. In India, people are very conscious to let go of their loans,” says Vipul Patel, chief executive officer, Mortgage World.

It takes at least 3-5 years for one to start lump sum repayments as some amount of corpus must be accumulated. If a lump sum payment is not working out, automating the prepayment can also be a viable option.

Also read | Applying for a home loan? How sanctioned amount is different from disbursed amount

Sen says, “Step one is to try and increase the EMI as that becomes an automatic prepayment rather than leaving it up to the person to decide each month; some spends can be too tempting and then the prepayment suffers.”

The home loan is only one part of your personal finances, you must consider the dynamics of other parts before committing to any kind of a prepayment schedule. Moreover, your prepayment schedule will depend on your unique circumstances.

Joshi has experienced different behaviour with his clients. “People prefer a single-shot, once-a-year repayment; with an increase in lifestyle expenses, it can become difficult to have a grip on increasing monthly savings,” he says.

Adjust your prepayment according to the changes happening in other financial objectives and keep your strategy flexible.

“Where a client has a large-sized loan remaining and no immediate big financial goals to attend to, there is an opportunity to prepay using all surpluses that get generated, monthly or annually. If on the other hand, the remaining loan is not significant, surpluses can get divided between prepayment and investments,” suggests Sen.

Buying your dream home is a big step, however, shouldering high interest costs is a burden you don’t need to carry for too long. Start with responsible loan size and focus on disciplined prepayment to minimise costs and maximise the pleasure of enjoying your home.

Also read | Increase home loan EMIs or tenure: What should borrowers do?

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now