Highlights

With focus on small-ticket finance (Rs. 5 - 10 Lakhs), the management expects higher margins in FY24 against the current level.

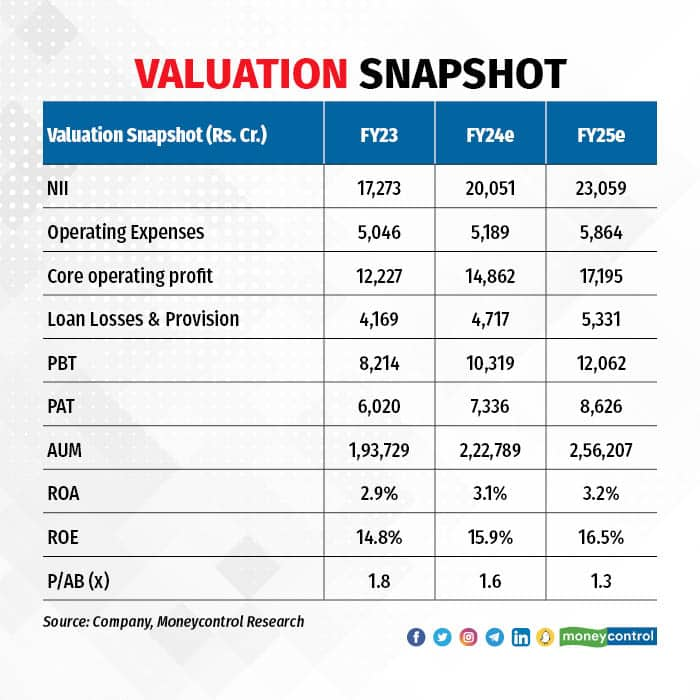

Moreover, the company reiterated its long-term AUM growth guidance of 15 percent (to reach Rs 5 Lakh crore by FY30), backed by expected strong credit cycles and expansion plans across the country.

The newly formed partnership with Paytm will further strengthen digital loan distribution, aiding overall loan growth.

Healthy disbursement and AUM growth

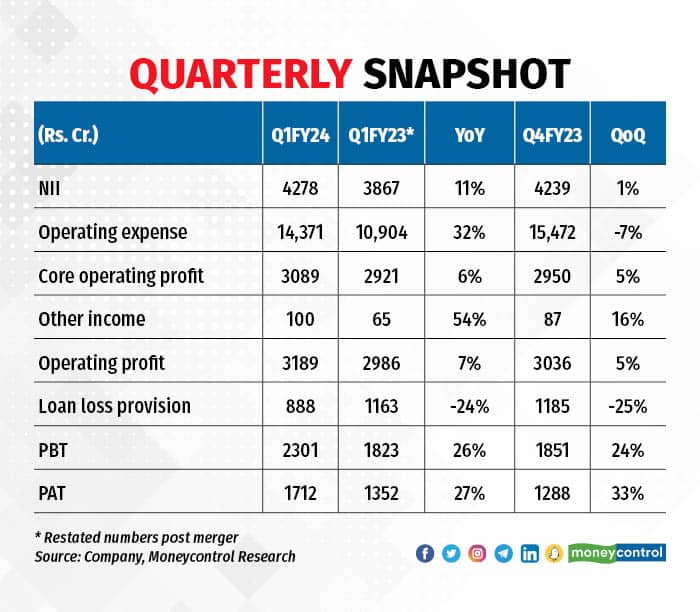

A healthy rise in disbursements (up 21.3 percent YoY to Rs 30,454 crore) is feeding the AUM growth.

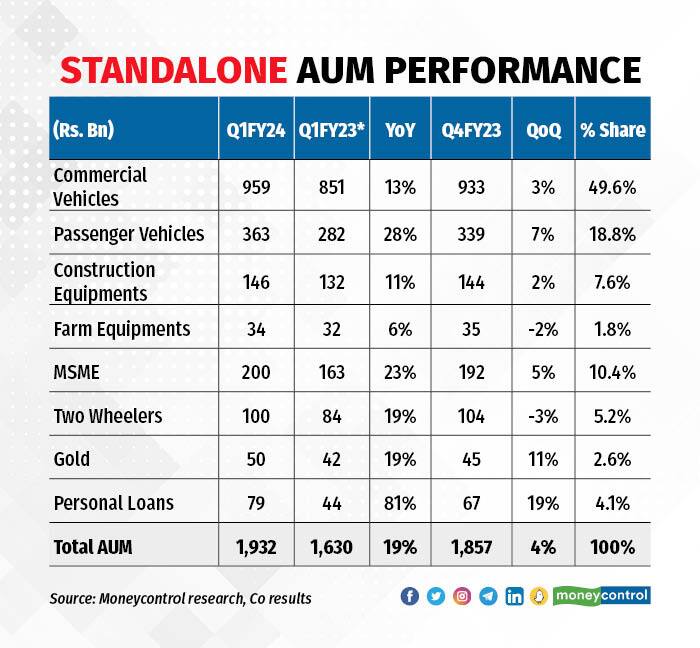

Sequentially, AUM has been growing at a decent pace, rising another 4 percent QoQ in Q1FY24, taking the total consolidated number to Rs 1,93,215 crore at the end of the June quarter (up 19 percent YoY). This was largely led by a double-digit growth in the personal loan segment (up 19 percent QoQ) and MSME (micro, small and medium enterprises).

The sequential growth in the Medium & Heavy CV (MHCV) segment was marginal at 3 percent in Q1 on account of lower monthly sales reported by major auto companies.

However, the management is confident that post monsoon demand will pick up for construction and farm equipment. Also, huge infrastructure projects will drive demand growth in the second half of FY24 (H2FY24) and the company expects double-digit growth in CV and two-wheeler segments.

Moreover, SFL is expanding its housing finance business (Shriram Housing Finance). The subsidiary saw a sharp growth in disbursement in the quarter, driving a 19 percent sequential growth in AUM to Rs 9,539 crore in the quarter.

The management expects to maintain the current YoY growth in AUM, and the CV and two-wheeler segments to contribute 12 percent and 15 percent YoY growth, respectively, in FY24.

Stable asset quality

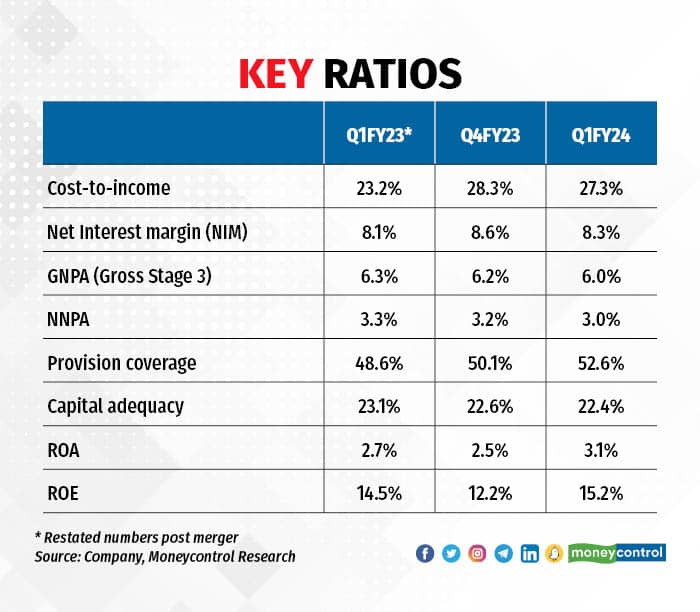

The asset quality was largely stable with a marginal improvement in gross stage 3 asset (down 18 bps QoQ to around 6.0 percent) in the quarter, backed by improved customer cash flows.

According to the company, the improvement in credit cost in the quarter was on account of improved macros and a rise in vehicle prices (up 25 to 30 percent).

The credit cost is guided to remain at around 2 percent in the coming fiscal. Also, the company increased its provision coverage ratio to around 53 percent.

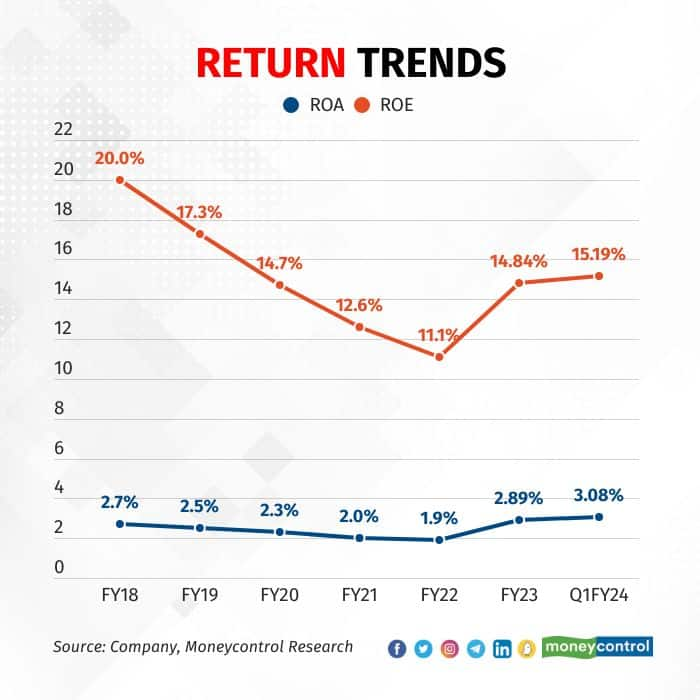

Improving profitability, steady return ratios

The net interest income (NII) growth was muted in the quarter and the NIM (net interest margin) dipped by 23 basis points QoQ to 8.3 percent on account of lower yield due to higher lending for new vehicles and the increase in cost of funds.

However, the lender does not see any rise in incremental cost. It is confident of maintaining the NIM at current levels and improving it to 8.5 percent, backed by a better asset mix.

The cost-to-income ratio improved sharply to 27.3 percent in Q1 against 28.3 percent in the previous quarter. It is expected to remain range bound between 27 percent and 28 percent.

The return on asset (ROA) surpassed the company’s expectations and improved by more than 60 basis points at around 3.1 percent. A sharp sequential rise was seen in the return on equity in Q1FY24 (ROE up by 298 bps QoQ to 15.2 percent).

For FY24, the ROA is guided to be range bound between 2.7 percent and 2.8 percent, and the ROE is expected to increase to 16 percent.

Outlook and valuation

Shriram is a pioneer in the NBFC industry and has a substantial rural footprint. Over 86 percent of the branches are in rural and semi-urban areas (85 percent of AUM), where demand has surpassed requirement from cities. With a better reach and access, Shriram is well-established to serve the expanding demand.

The next big opportunity will come from MSME lending. Shriram Finance is a market leader in commercial vehicle (CV) and two-wheeler lending. Although, CV is the largest business line, non-vehicle lending share (high-yield) is expanding.

The growth strategy to expand small businesses could enable the company to strengthen its position in MSME lending and close the vast funding gap (Rs. 32 lakh crore) in the sector.

According to the company’s board, optimisation of cost, improved financial risk profile and capitalisation, and increased diversification of product portfolio along with co-lending tie-ups will support earnings following the merger.

The valuation at 1.3x FY25e adjusted book looks attractive given the healthy disbursement growth and the stable asset quality coupled with the merger benefits.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now