Highlights:

With the waning impact of semiconductor chip shortage and the softening of raw material prices, Tata Motors (TML; CMP: Rs 641.8; Market cap: Rs 2.31 lakh crore) has posted a strong set of numbers in the first quarter of FY24.

Q1 FY24 quarter snapshot

Key highlights

JLR: rich product mix fuelled operating profitability

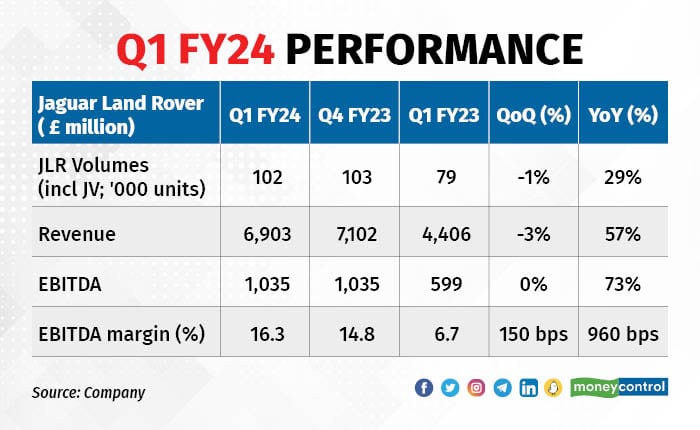

Backed by new products, and strong demand, the company was able to register a 29 percent year-on-year (YoY) growth in volumes. Its revenues, however, registered a much higher growth of 57 percent YoY, thanks to the higher realisation on the back of a new product range.

Higher revenue and the softening of raw material prices led JLR to post an EBITDA (earnings before interest, tax, depreciation and amortisation) margin above 16 percent – a commendable performance. The margin expanded by a whopping 960 basis points on a YoY basis.

Domestic business: in-line operating performance

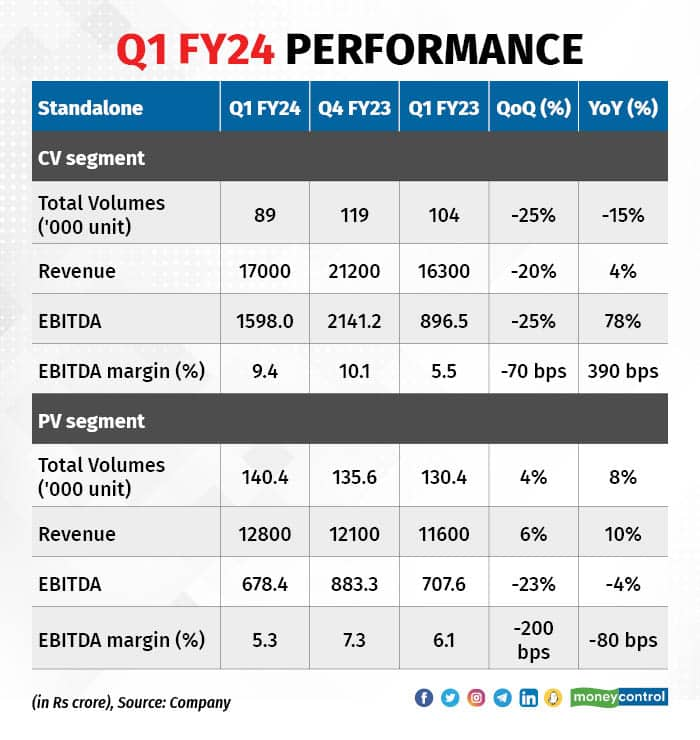

TML’s domestic business also posted a strong set of numbers. Despite a 15 percent YoY decline in commercial vehicle (CV) volumes due to the unavailability of BS6 phase-2 vehicles, the company registered a 4 percent growth in revenues, led by a rich product mix and higher prices. Consequently, it reported a whopping 390-basis-point expansion in its EBITDA margin on a YoY basis.

Vehicle shortage also impacted its market share, which contracted to 39.1 percent in Q1 FY24 compared with 41.7 percent at the end of FY23.

The PV segment, on the other hand, posted a YoY growth of 8 percent in volumes, driven by a strong product portfolio. The softening of raw material prices helped the company to maintain its margin on a YoY basis.

Outlook

JLR: healthy order book

Though JLR is still facing challenges due to the shortage of semiconductor chips, the company has taken various measures, such as engaging directly with chip suppliers, to reduce the impact. It expects chip supplies to get better in the coming quarters of FY24.

Demand, on the other hand, continues to be very robust. This is evident from the retail orders across geographies — 185,000 units at the end of Q1 FY24.

New models, such as the Defender, new Evoque, and the Discovery Sport, have been well received and are expected to boost the company’s volumes. This is apparent from the company’s orders. Further, JLR has launched a new Range Rover, the production of which has improved to over 2,800 units per week in Q1 FY24 from 2,300 units per week in Q4 FY23.

With chip supply improving, production is expected to get better, going forward.

The impact of strong profitability was visible in JLR’s cash flow. It generated a positive cash flow of £451 million.

Domestic business: CV, PV to maintain their momentum

The management believes that the demand momentum is expected to continue on the back of a strong recovery in macroeconomic activities and the opening up of the broader economy.

Further, the government’s focus on infrastructure, which is driving demand recovery in cement, steel, and minerals, should also boost CV demand. The management expects single-digit volume growth in the CV segment in FY24.

The company expects the PV business to maintain momentum on the back of people’s preference for personal transportation. According to the management, the industry is projected to grow 5-7 percent in FY24 due to the higher base of FY23.

In light of the strong demand, the management has indicated that the company will continue to step up investments in products and new business models to deliver value to customers while ensuring profitable growth.

The management aims to reach a double-digit EBITDA in the coming years in both these segments and sustain positive free cash flows.

EV business: already a leader, competition is emerging

At present, TML is the undisputed leader in the electric vehicle (EV) segment in India, and it has three products. On the back of its product performance, TML has been able to capture 83.9 percent market share in the domestic EV segment.

The company registered an EV quarterly sales figure of 19346 units in Q1 FY24, up 104.8 percent from the same quarter last year.

With competition emerging, the market share has seen a decline from 83.9 percent in Q4 FY23 to 76 percent in Q1 FY24.

Corporate action: proposal to delist DVR shares

The company has proposed a scheme of cancellation of DVR shares by offering 7 ordinary shares for every 10 DVR share held by the shareholders; this translates to a 23 percent premium to the previous day’s closing price of DVR shares and 30 percent discount to ordinary share price against the 43 percent prevailing discount. The transaction will reduce the total share capital by 4 percent, making it EPS accretive for all shareholders.

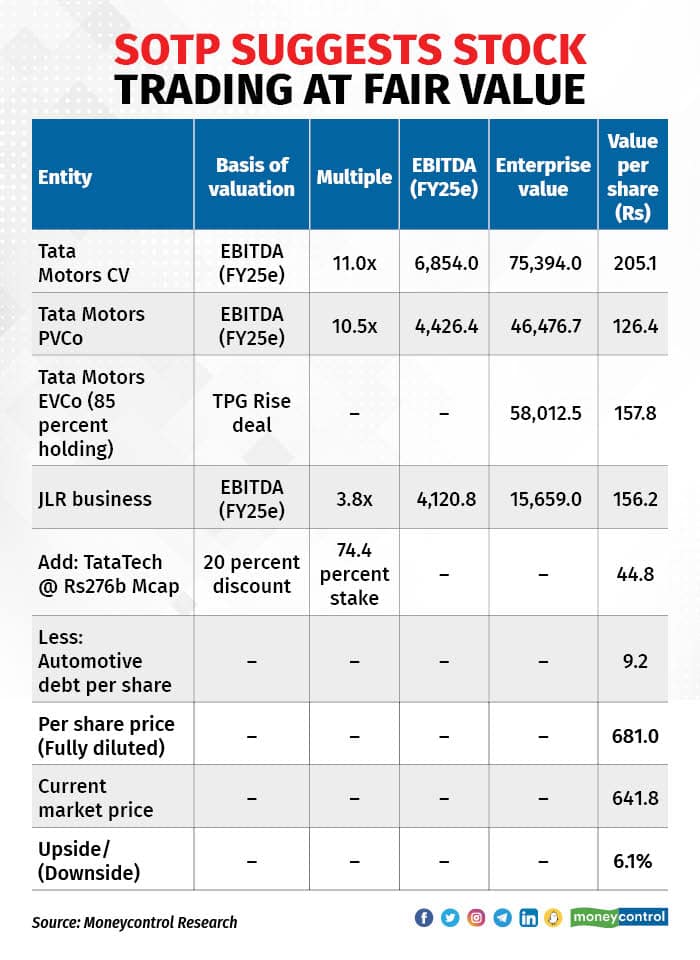

Valuation

According to our sum-of-the-parts (SOTP) valuation, the stock now offers a 6 percent upside as it has already run up 71 percent from its 52-week low attained in December 2022 . We advise investors to accumulate on correction.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now