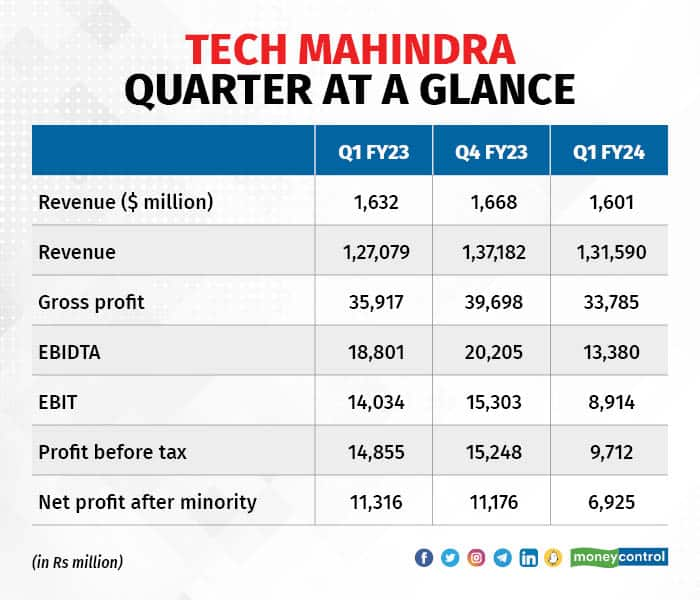

Highlights

Q1 FY24 – disappointment on all fronts

Source: Company

Source: Company

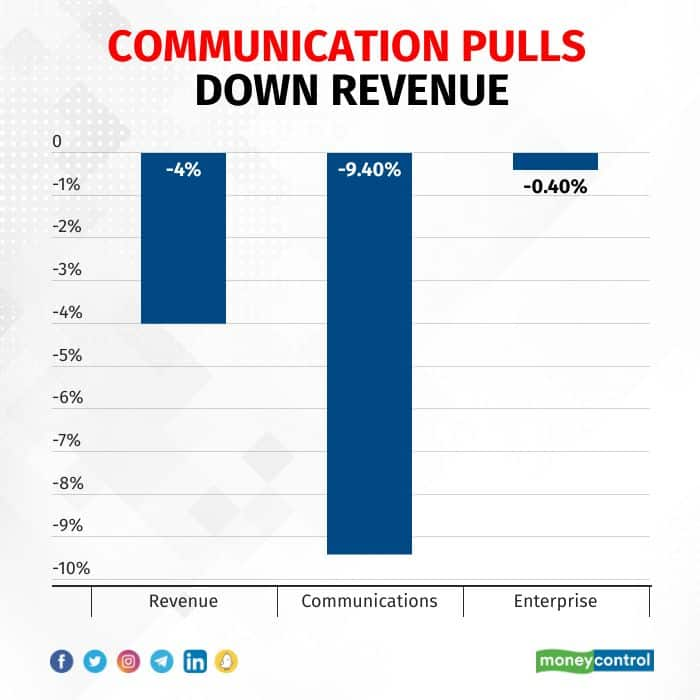

Revenue nosedives

Revenue for the quarter at $1601 million declined 4 percent in reported currency and 4.2 percent in Constant Currency (CC). The sharp decline in the communications vertical resulted in this large revenue miss. The company attributed it to the completion of a few transformative projects, delay and deferment of discretionary projects, bankruptcy in one client, and seasonal weakness in subsidiary Comviva.

Source: Company

Source: Company

Even within enterprise, manufacturing was the only bright spot. In terms of key markets, Americas was flat whereas a steep decline was seen in Europe and the rest of the world on project closure and spending cuts by telcos.

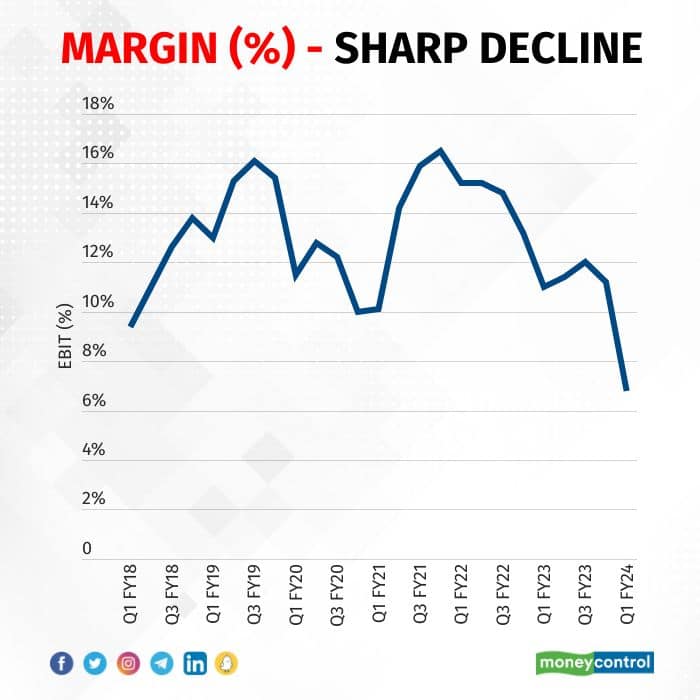

Margins collapse

The quarter saw one of the worst margin performances in recent memory with a sequential decline in margin by over 450 basis points. Close to 200 basis points of this decline was on account of the revenue decline. The bankruptcy of a client and the resultant provision also had a similar impact on the margin whereas the remaining 50 basis points was on account of the weakness in Comviva.

Source: Company

Source: Company

Despite revenue headwinds, the company went ahead and effected its annual wage revision for the majority of employees which had a 130-basis-point margin impact. The revision for the remaining employees effective Q2 would have a lower impact.

While utilisation remains high at 87 percent and has not much headroom, the management alluded to several levers for margin improvement, including lower subcontracting cost that, as a percentage of revenue at 14 percent, has room to fall below 10 percent. Correcting the pyramid by deploying more freshers, higher offshoring, which can go up by another 4-5 percent, and divestment of non-core businesses are the other levers at the company’s disposal. We feel margin improvement will be a gradual exercise and is contingent on the uptick in the demand environment as well. We have built in gradual improvement in our estimates.

Order inflow slows down

Order intake was weak — down year on year (YoY) and quarter on quarter (QoQ). While alluding to a better second half, the commentary on demand deserves focus. The management called out reprioritisation of spending by telcos away from 5G, hold on discretionary spending, and meaningful cutting down of discretionary transformation projects as enterprises across verticals focus on return on investment in the short term and are on a cash conservation mode due to the steep hike in capital costs.

Source: Company

Deal wins in the past four quarters have been lower by close to 25 percent YoY which give an indication of a relatively soft revenue trajectory ahead.

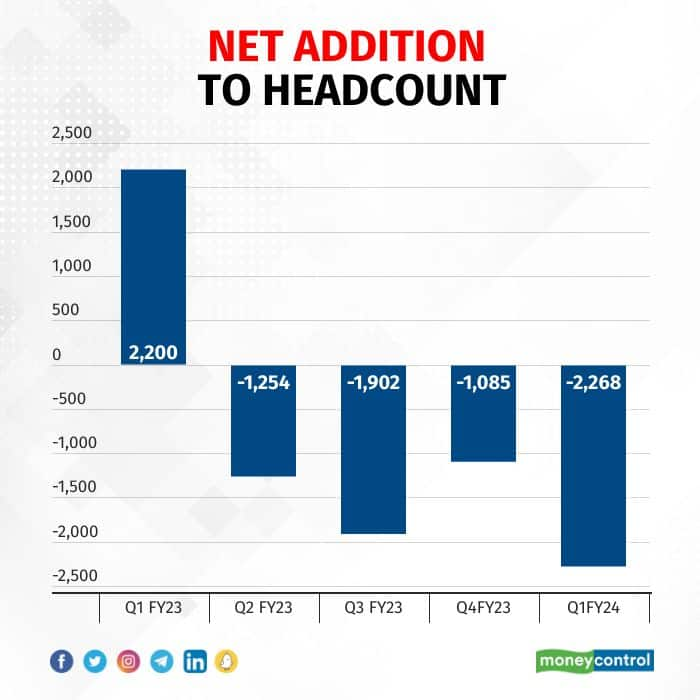

Headcount continues to fall

Despite an elevated utilisation, overall headcount declined for the third consecutive quarter, while the headcount for software professionals declined for the fourth consecutive quarter. This is one one more pointer to a near-term subdued outlook.

Source: Company

The only good news is the decline in attrition from 15 percent to 13 percent. This should take some pressure off wage increments amid the several challenges the company is battling.

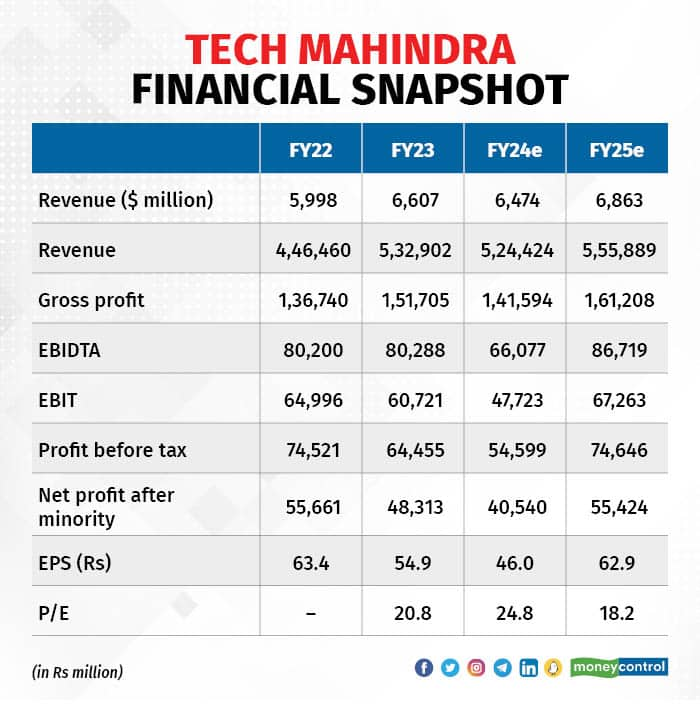

While we agree that the worst may be over, we expect the recovery to be gradual and nothing meaningful to excite investors in the near term. Given the decline in earnings in FY24, we expect a modest 7 percent CAGR in earnings between FY23-FY25e. Seen in this context, the valuation on PEG basis (price earnings to growth) is too costly at 2.6. The stock has to correct meaningfully before putting a bet for the long term.

Source: Company, Moneycontrol Research

Key risks: Severe contraction in technology budgets for a long period

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now