This week the US Fed increased its policy rate by 25 bps, taking the overnight rate to 5.25-5.5 percent, the highest level in more than two decades. To be sure, this hike was along expected lines because despite the breather taken by the Fed in June, its narrative had left room open for a couple of hikes.

However, what has dampened sentiment is that the Fed Chairman did not indicate a potential end to the rate-hike cycle. In fact, Powell has kept the future trajectory too open-ended for comfort. There could be more hikes on the way if incoming data so indicates or this could also be the last hike if warranted by incoming data.

With Fed’s decisions being made on a meeting-by-meeting basis, it makes sense to have a look at the picture painted by data before going into what the Fed’s latest move means for Indian stock markets.

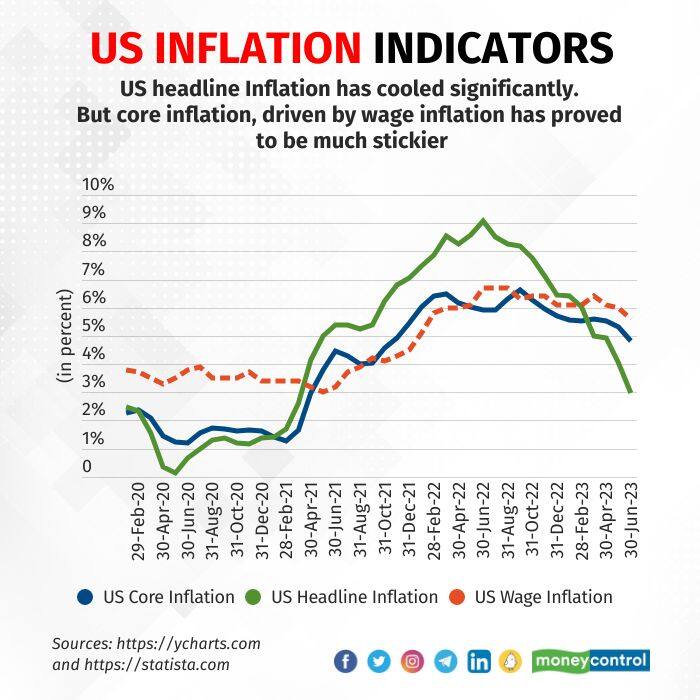

Cooling headline inflation could be a red herring

Headline inflation in the US has been on a steep downtrend since June 2022 when it peaked at 9.1 percent. In the year since then it has cooled off sharply and the latest print came in a little shy of 3 percent. While still above the target of 2 percent, the steep downtrend is nothing to scoff at. Leaving aside the volatile components of food and fuel, core inflation too mellowed to 4.8 percent in June from 5.3 percent in May. This drop in core inflation was led by a fall in wage-inflation from 6 percent in May to 5.6 percent in June. In June, it seemed like the inflation story was moving along in the right direction on all fronts.

Still, the Fed raised policy rates by quarter of a percentage point, and the markets expected it too. Apart from the Fed’s own narrative suggesting such a hike, the trends in wage growth and core inflation also suggest that it is indeed too soon to let our guard down in the fight against inflation.

While headline inflation has dropped sharply, core inflation has proven to be much more persistent. Despite rising borrowing costs and growth pangs among global peers including China and the Eurozone, the US economy has been resilient. US GDP growth projection for 2023 was revised upwards from 0.4 percent to 1 percent. Labour market has been tight and wage growth has been persistent, thereby keeping core inflation hovering around 5.5 percent despite an aggressive rate-hike trajectory followed by the Fed.

While the latest downtick in wage growth and core inflation in the US is promising, extrapolating the move into the future could prove dangerous. This is particularly true now since uneven rainfall and production cuts by the OPEC+ threaten to reverse the recent downtrends in the prices of food and fuel. This could potentially push headline inflation back up, thereby necessitating caution in monetary policies.

Narrowing yield spreads can spook FIIs

The fundamental risk arising from high interest rates is that of a slowdown in economic growth. But the US economy’s resilience has all but ruled out a recession for the time being, as pointed out by the Fed Chairman. This spells good news for exporters catering to the US.

Having said that, higher rates in the US or rather a narrowing rate-differential between the US and India could draw foreign funds out of India. If the incoming data on inflation and GDP growth here onwards does make a case for further hikes by the US, and if the RBI hangs on to its pause on hikes, the rate differential would narrow further, and could potentially reverse the recent FII inflows.

We have already seen a trailer playing out on Thursday when FIIs sold off Indian equities worth almost Rs 4,000 crore in a single day. In response, the Nifty wiped out all opening gains to touch lows of 19,600 during the day.

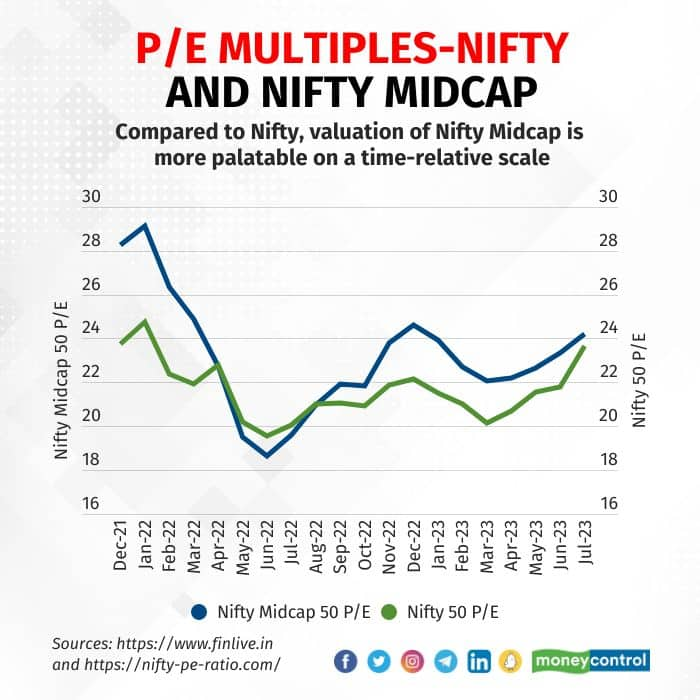

Overheated markets get spooked easily

The post-open drop in sentiment can be attributed to a whole range of factors – from idiosyncratic factors like announcements of M&M’s acquisition and ITC’s demerger, to disappointment in Q1 earnings as well as systematic factors such as the realization that the Fed has left room open for further hikes.

But the point to note is that such idiosyncratic as well as systematic shocks could have been absorbed had the markets not been overheated. Just like it is easier to pop a fuller balloon, it is easier to shock markets which are trading at premium valuations. This is evident in how Nifty Midcap 50 with its more modest valuations, appreciated by 0.60 percent today while Nifty 50 trading at 19-month high valuations, corrected by 0.60 percent.

Indian stock markets can be expected to remain volatile until fundamentals catch up with the valuations. Until then, overheated pockets of the market are likely to remain more vulnerable to shocks. Short-term investors and traders are advised to practice strict position-sizing and risk management principles. Long-term investors should use dips as opportunities to load up on fundamentally strong businesses available at attractive valuations.

Ananya Roy is a fund manager. Twitter: @ananyaroycfa. Views are personal, and do not represent the stand of this publication.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Cipla, Dr Reddy’s deliver a pep pill for pharma stocks

Jul 27, 2023 / 03:58 PM IST

In today’s edition of Moneycontrol Pro Panorama: New Delhi needs strategic approach towards China, Colgate brings cheers to inve...

Read Now

Moneycontrol Pro Weekender: Climbing Mount 20k

Jul 22, 2023 / 10:00 AM IST

Emerging markets are in the spotlight as the shift in foreign capital flows has been driven by disappointment about China’s reco...

Read Now