We have seen the market extending its recovery on July 26 after a recent correction, as the benchmark indices clocked half a percent gains with support from most sectors. Going ahead, the Nifty50 needs to take support at 5-day EMA to see the sustained uptrend towards its record high, experts said, adding the crucial support would be 19,650 levels. The near term range may be 19,600-19,900 levels.

The BSE Sensex rallied over 350 points to 66,707, while the Nifty50 gained nearly 100 points at 19,778 and formed bullish candlestick pattern with small upper shadow on the daily charts, which resembles Inside Bar kind of pattern formation as the index traded within previous day's range.

The market breadth was tilted in favour of bulls, possibly helping the broader markets end with decent gains. The Nifty Midcap 100 index gained 0.4 percent and Smallcap 100 index was up 0.2 percent.

Bank Nifty climbed above 46,000 mark after recent correction and consolidation, closing with more than 200 points rally at 46,062, while the Nifty IT rose 39 points to 29,800.

Stocks that were in action included Jyothy Labs, Castrol India, and KEC International.

Jyothy Labs rallied nearly 8 percent to end at a record closing high of Rs 314 and formed bullish candlestick pattern with long upper & lower shadows on the daily charts after a day of 20 percent upper circuit. The stock has seen robust trading volumes in two consecutive sessions, and traded way above key moving averages (20, 50 and 200-day EMA - exponential moving average).

Castrol India shares jumped nearly 7 percent to Rs 145, the highest closing level since October 18, 2021 and formed strong bullish candlestick pattern on the daily charts with healthy volumes. The stock has been making higher highs for a fourth straight session, with taking support at 10-day EMA (Rs 135).

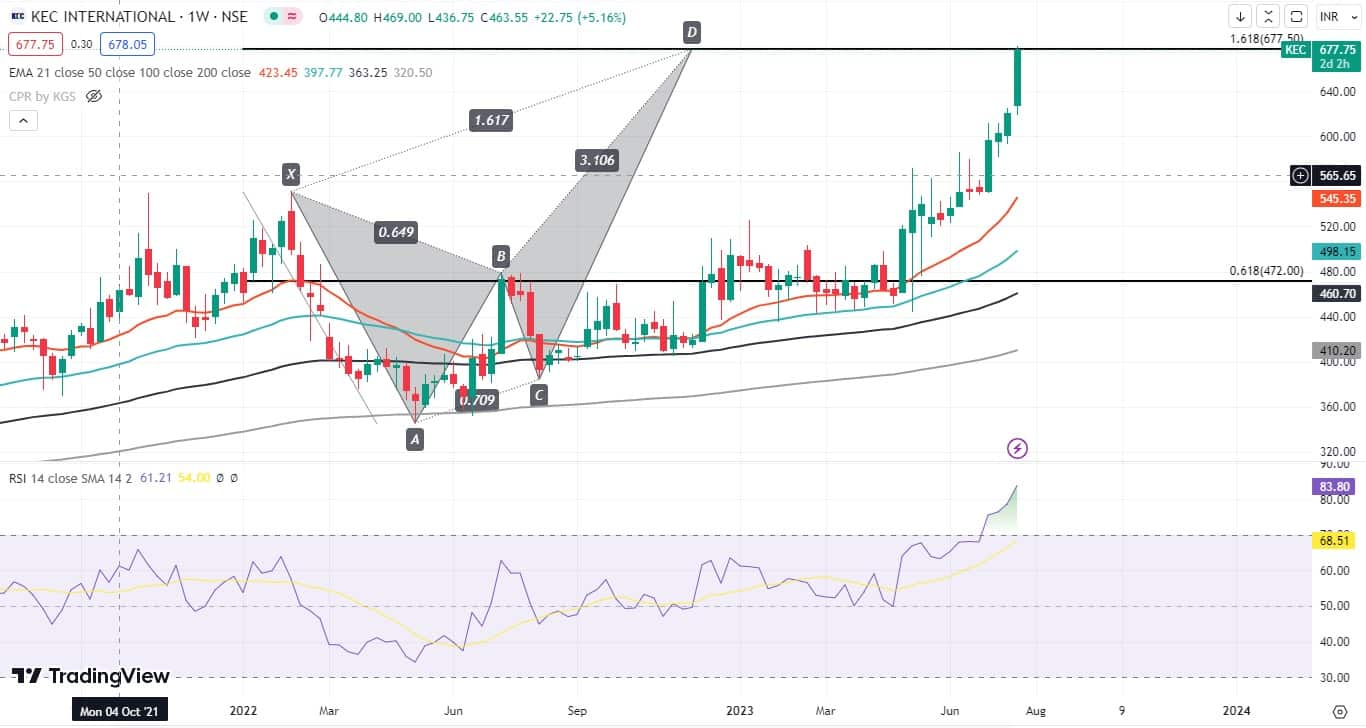

KEC International continued to rally for the fourth consecutive session, rising 4 percent to end at record closing high of Rs 674.5. The stock has formed long bullish candlestick pattern on the daily charts with above average volumes, while nicely taking support at 10-day EMA (Rs 625)

Here's what Jigar S Patel of Anand Rathi Shares & Stock Brokers recommends investors should do with these stocks when the market resumes trading today:

In the current month, the said counter has already given a 48-percent return and currently trading near Rs 310 mark. Though it looks lucrative due to its recent up-move, it is about to make a Bearish Crab pattern near Rs 330-340 levels on a monthly scale.

Having said that on a daily scale, the price action is way above its all-major exponential moving averages. So, one needs to avoid fresh longs at the current juncture. On the other hand, if one is already holding position, one can book profits in the range of Rs 325-340.

Recently, the said counter has taken out its downward slope bearish trendline. Moreover, it is sustaining above its all-major exponential moving averages (refer to the chart).

On the indicator front, weekly RSI (relative strength index) is above 70 which hints towards further bullish momentum in the counter. One can buy between Rs 142 and 144 with an upside target of Rs 160 and the stop-loss would be Rs 134.

In the current month, the said counter has already given a 23-percent return and is currently trading near the Rs 680 mark. Though it looks lucrative due to its recent up-move, it is about to make a Bearish Crab pattern near Rs 670-680 levels on a weekly scale (refer to the chart).

Having said that on a daily scale, the price action is way above its all-major exponential moving averages. So, one needs to avoid fresh longs at the current juncture. On the other hand, if one is already holding position, one can book profits in the range of Rs 670-690.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!